Business, 16.04.2020 01:06 thompsonmark0616

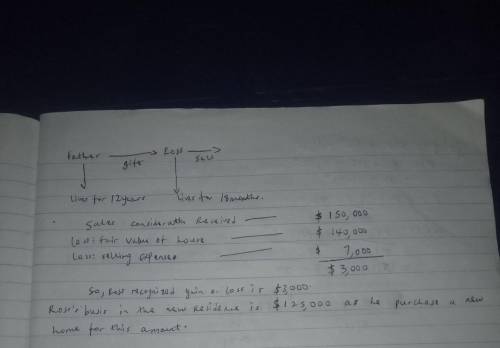

Ross lives in a house he received as a gift from his father. His father had lived in the house for 12 years.

The adjusted basis of the house to his father was $160,000 and the fair market value at the time of the gift was $140,000.

Ross sells this residence after living in it for 18 months for $150,000 and purchases a new home for $125,000. He incurs selling expenses of $7,000.

What is Ross' recognized gain or loss and basis for the new residence?

Answers: 2

Another question on Business

Business, 22.06.2019 04:50

Neveready flashlights inc. needs $317,000 to take a cash discount of 3/15, net 70. a banker will loan the money for 55 days at an interest cost of $13,200. a. what is the effective rate on the bank loan? (use a 360-day year. do not round intermediate calculations. input your answer as a percent rounded to 2 decimal places.) b. how much would it cost (in percentage terms) if the firm did not take the cash discount but paid the bill in 70 days instead of 15 days? (use a 360-day year. do not round intermediate calculations. input your answer as a percent rounded to 2 decimal places.) c. should the firm borrow the money to take the discount? no yes d. if the banker requires a 20 percent compensating balance, how much must the firm borrow to end up with the $317,000? e-1. what would be the effective interest rate in part d if the interest charge for 55 days were $7,200?

Answers: 3

Business, 22.06.2019 16:00

Three pounds of material a are required for each unit produced. the company has a policy of maintaining a stock of material a on hand at the end of each quarter equal to 30% of the next quarter's production needs for material a. a total of 35,000 pounds of material a are on hand to start the year. budgeted purchases of material a for the second quarter would be:

Answers: 1

Business, 22.06.2019 20:00

On january 1, year 1, purl corp. purchased as a long-term investment $500,000 face amount of shaw, inc.’s 8% bonds for $456,200. the bonds were purchased to yield 10% interest. the bonds mature on january 1, year 6, and pay interest annually on january 1. purl uses the effective interest method of amortization. what amount (rounded to nearest $100) should purl report on its december 31, year 2, balance sheet for these held-to-maturity bonds?

Answers: 1

You know the right answer?

Ross lives in a house he received as a gift from his father. His father had lived in the house for 1...

Questions

History, 10.06.2021 07:40

Mathematics, 10.06.2021 07:40

Physics, 10.06.2021 07:40

Spanish, 10.06.2021 07:40

Mathematics, 10.06.2021 07:40

Social Studies, 10.06.2021 07:40

Physics, 10.06.2021 07:40

Mathematics, 10.06.2021 07:40

Mathematics, 10.06.2021 07:40

Mathematics, 10.06.2021 07:40

Mathematics, 10.06.2021 07:40