Business, 21.04.2020 01:49 tiearahill2393

Gold Nest Company of Guandong, China, is a family-owned enterprise that makes birdcages for the South China market. The company sells its birdcages through an extensive network of street vendors who receive commissions on their sales.

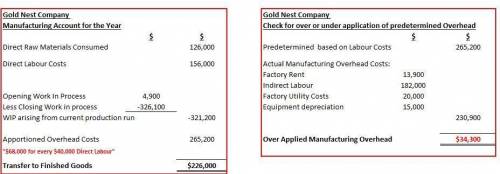

The company uses a job-order costing system in which overhead is applied to jobs on the basis of direct labor cost. Its predetermined overhead rate is based on a cost formula that estimated $68,000 of manufacturing overhead for an estimated activity level of $40,000 direct labor dollars. At the beginning of the year, the inventory balances were as follows:

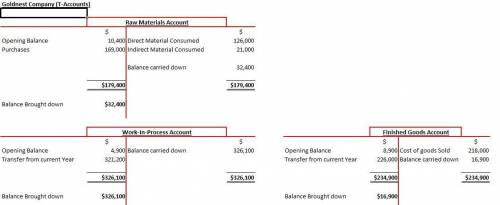

Raw materials $ 10,400

Work in process $ 4,900

Finished goods $ 8,900

During the year, the following transactions were completed:

a. Raw materials purchased on account, $ 169,000.

b. Raw materials used in production, $147,000 (materials costing $126,000 were charged directly to jobs; the remaining materials were indirect).

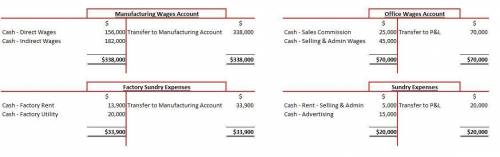

c. Costs for employee services were incurred as follows:

Direct labor $ 156,000

Indirect labor $ 182,000

Sales commissions $ 25,000

Administrative salaries $ 45,000

d. Rent for the year was $18,900 ($13,900 of this amount related to factory operations, and the remainder related to selling and administrative activities).

e. Utility costs incurred in the factory, $20,000.

f. Advertising costs incurred, $15,000.

g. Depreciation recorded on equipment, $21,000.($15,000 of this amount related to equipment used in factory operations; the remaining $6,000 related to equipment used in selling and administrative activities.)

h. Record the manufacturing overhead cost applied to jobs.

i. Goods that had cost $226,000 to manufacture according to their job cost sheets were completed.

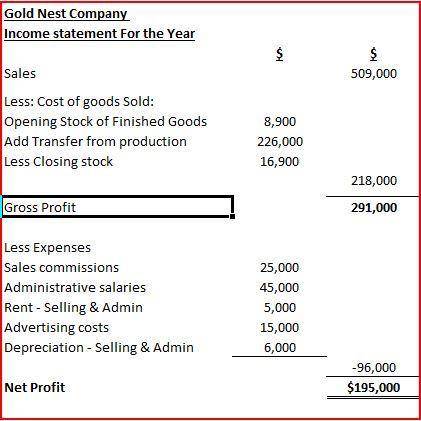

j. Sales for the year (all paid in cash) totaled $509,000. The total cost to manufacture these goods according to their job cost sheets was $218,000.

Required:

1. Prepare journal entries to record the transactions for the year.

2. Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your journal entries to these T-accounts (don't forget to enter the beginning balances in your inventory accounts).

3A. Is Manufacturing Overhead underapplied or overapplied for the year?

3B. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold.

4. Prepare an income statement for the year. All of the information needed for the income statement is available in the journal entries and T-accounts you have prepared.

Answers: 3

Another question on Business

Business, 22.06.2019 07:30

When the national economy goes from bad to better, market research shows changes in the sales at various types of restaurants. projected 2011 sales at quick-service restaurants are $164.8 billion, which was 3% better than in 2010. projected 2011 sales at full-service restaurants are $184.2 billion, which was 1.2% better than in 2010. how will the dollar growth in quick-service restaurants sales compared to the dollar growth for full-service places?

Answers: 2

Business, 22.06.2019 08:40

Which of the following statements is true regarding the reporting of outside interests and the management of conflicts? investigators are responsible for developing their own management plans for significant financial interests. the institution must report identified financial conflicts of interest to the u.s. office of research integrity. investigators must disclose their significant financial interests related to their institutional responsibilities and not just those related to a particular project. investigators must disclose all of their financial interests regardless of whether they are related to a research project.

Answers: 3

Business, 22.06.2019 12:50

You are working on a bid to build two city parks a year for the next three years. this project requires the purchase of $249,000 of equipment that will be depreciated using straight-line depreciation to a zero book value over the three-year project life. ignore bonus depreciation. the equipment can be sold at the end of the project for $115,000. you will also need $18.000 in net working capital for the duration of the project. the fixed costs will be $37000 a year and the variable costs will be $148,000 per park. your required rate of return is 14 percent and your tax rate is 21 percent. what is the minimal amount you should bid per park? (round your answer to the nearest $100) (a) $214,300 (b) $214,100 (c) $212,500 (d) $208,200 (e) $208,400

Answers: 3

Business, 22.06.2019 16:40

Determining effects of stock splits oracle corp has had the following stock splits since its inception. effective date split amount october 12, 2000 2 for 1 january 18, 2000 2 for 1 february 26, 1999 3 for 2 august 15, 1997 3 for 2 april 16, 1996 3 for 2 february 22, 1995 3 for 2 november 8, 1993 2 for 1 june 16,1989 2 for 1 december 21, 1987 2 for 1 march 9, 1987 2 for 1 a. if the par value of oracle shares was originally $2, what would oracle corp. report as par value per share on its 2015 balance sheet? compute the revised par value after each stock split. round answers to three decimal places.

Answers: 1

You know the right answer?

Gold Nest Company of Guandong, China, is a family-owned enterprise that makes birdcages for the Sout...

Questions

Social Studies, 19.02.2021 09:00

Mathematics, 19.02.2021 09:00

Mathematics, 19.02.2021 09:00

Mathematics, 19.02.2021 09:00

Mathematics, 19.02.2021 09:00

History, 19.02.2021 09:00

Mathematics, 19.02.2021 09:00

Chemistry, 19.02.2021 09:00

Mathematics, 19.02.2021 09:00

Mathematics, 19.02.2021 09:00

Biology, 19.02.2021 09:00