Business, 21.04.2020 03:12 karlyisaunicorn

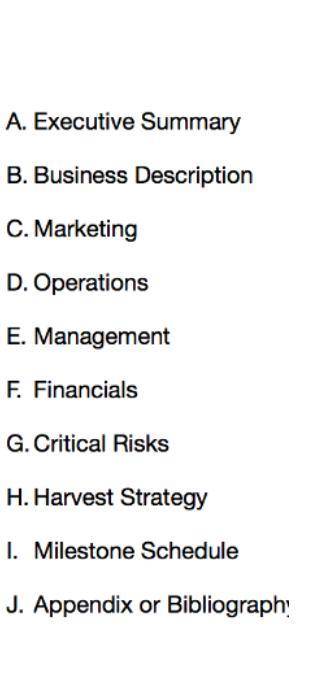

Choose the appropriate business plan segment that corresponds with the following descriptions.

a. Describes the potential of the new venture.

b. Discusses the advantages of location.

c. Discusses price-cutting by the competition.

d. Provides strategy for an initial public offering.

e. Most crucial part of the plan

f. Describes any prototypes developed

g. Analyzes case if any sales projections are not attained

h. Shows the relationship between events and deadlines for accomplishment

i. Provides résumés of all key personnel

j. Contains support material such as blueprints and diagrams

k. Discusses pricing strategy

l. Should be written after the business plan is completed

m. Provides a budget Explains proximity to suppliers

n. Sets forth timetables for completion of major phases of the venture

o. Provides industry background

p. Explains costs involved in testing Identifies target markets

q. Describes legal structure of the venture

r. Provides balance sheet and income statement

Answers: 3

Another question on Business

Business, 22.06.2019 08:40

Which of the following is not a characteristic of enterprise applications that cause challenges in implementation? a. they introduce "switching costs," making the firm dependent on the vendor. b. they cause integration difficulties as every vendor uses different data and processes. c. they are complex and time consuming to implement. d. they support "best practices" for each business process and function. e. they require sweeping changes to business processes to work with the software.

Answers: 1

Business, 22.06.2019 12:30

Rossdale co. stock currently sells for $68.91 per share and has a beta of 0.88. the market risk premium is 7.10 percent and the risk-free rate is 2.91 percent annually. the company just paid a dividend of $3.57 per share, which it has pledged to increase at an annual rate of 3.25 percent indefinitely. what is your best estimate of the company's cost of equity?

Answers: 1

Business, 22.06.2019 15:20

Capital financial corporation will lend 90 percent against account balances that have averaged 30 days or less; 80 percent for account balances between 31 and 40 days; and 70 percent for account balances between 41 and 45 days. customers that take over 45 days to pay their bills are not considered acceptable accounts for a loan. the current prime rate is 16.50 percent, and capital charges 3.50 percent over prime to charming as its annual loan rate. a. determine the maximum loan for which charming paper company could qualify.

Answers: 1

Business, 22.06.2019 16:40

Determining effects of stock splits oracle corp has had the following stock splits since its inception. effective date split amount october 12, 2000 2 for 1 january 18, 2000 2 for 1 february 26, 1999 3 for 2 august 15, 1997 3 for 2 april 16, 1996 3 for 2 february 22, 1995 3 for 2 november 8, 1993 2 for 1 june 16,1989 2 for 1 december 21, 1987 2 for 1 march 9, 1987 2 for 1 a. if the par value of oracle shares was originally $2, what would oracle corp. report as par value per share on its 2015 balance sheet? compute the revised par value after each stock split. round answers to three decimal places.

Answers: 1

You know the right answer?

Choose the appropriate business plan segment that corresponds with the following descriptions.

Questions

Mathematics, 30.10.2021 14:00

Biology, 30.10.2021 14:00

Mathematics, 30.10.2021 14:00

English, 30.10.2021 14:00

History, 30.10.2021 14:00

Mathematics, 30.10.2021 14:00

English, 30.10.2021 14:00

History, 30.10.2021 14:00

Mathematics, 30.10.2021 14:00

Mathematics, 30.10.2021 14:00

Mathematics, 30.10.2021 14:00