Business, 22.04.2020 00:55 living8539

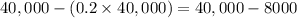

Suppose that there is a flat 20% income tax rate, but otherwise the US tax law is the same as that in place. You make $40,000 per year. If your employer pays for your $4,000 per year insurance policy and deducts the expense from your salary, your after-tax, after-insurance take-home pay is . If instead you pay for your $4,000 per year policy directly, your after-tax, after-insurance take-home pay is .

Answers: 2

Another question on Business

Business, 21.06.2019 21:00

Consider a small island country whose only industry is weaving. the following table shows information about the small economy in two different years. complete the table by calculating physical capital per worker as well as labor productivity. hint: recall that productivity is defined as the amount of goods and services a worker can produce per hour. in this problem, measure productivity as the quantity of goods per hour of labor. year physical capital labor force physical capital per worker labor hours output labor productivity (looms) (workers) (looms) (hours) (garments) (garments per hour of labor) 2024 160 40 1,800 14,400 2025 180 60 3,900 23,400

Answers: 2

Business, 22.06.2019 14:40

Which of the following statements about revision is most accurate? (a) you must compose first drafts quickly (sprint writing) and return later for editing. (b) careful writers always revise as they write. (c) revision is required for only long and complex business documents. (d) some business writers prefer to compose first drafts quickly and revise later; others prefer to revise as they go.

Answers: 3

Business, 22.06.2019 21:10

Match the terms with their correct definition. terms: 1. accounts receivable 2. other receivables 3 debtor 4. notes receivable 5. maturity date 6. creditor definitions: a. the party to a credit transaction who takes on an obligation/payable. b. the party who receives a receivable and will collect cash in the future. c. a written promise to pay a specified amount of money at a particular future date. d. the date when the note receivable is due. e. a miscellaneous category that includes any other type of receivable where there is a right to receive cash in the future. f. the right to receive cash in the future from customers for goods sold or for services performed.

Answers: 1

Business, 22.06.2019 22:00

The company is experiencing an increase in competition, and at the same time they are building more production facilities in southeast asia. in this scenario, the top management team is most likely to multiple choice increase the cost of their products. restructure to reflect a more bureaucratic, stable organization. pull decision-making responsibility from low-level management, taking it on themselves. give lower-level managers the authority to make decisions to benefit the firm. rid themselves of all buffering product.

Answers: 3

You know the right answer?

Suppose that there is a flat 20% income tax rate, but otherwise the US tax law is the same as that i...

Questions

Mathematics, 18.09.2020 14:01

Mathematics, 18.09.2020 14:01

Mathematics, 18.09.2020 14:01

Mathematics, 18.09.2020 14:01

Mathematics, 18.09.2020 14:01

Mathematics, 18.09.2020 14:01

Mathematics, 18.09.2020 14:01

Mathematics, 18.09.2020 14:01

English, 18.09.2020 14:01

Mathematics, 18.09.2020 14:01

Mathematics, 18.09.2020 14:01

Mathematics, 18.09.2020 14:01

Chemistry, 18.09.2020 14:01

History, 18.09.2020 14:01

Mathematics, 18.09.2020 14:01

Mathematics, 18.09.2020 14:01

History, 18.09.2020 14:01

Mathematics, 18.09.2020 14:01

Mathematics, 18.09.2020 14:01

Mathematics, 18.09.2020 14:01

=$32,000Now,the company deducts $4000 from the after tax annual income as insurance expense.Therefore,after-tax and after-insurance annual take home income=

=$32,000Now,the company deducts $4000 from the after tax annual income as insurance expense.Therefore,after-tax and after-insurance annual take home income= =$28,000If we consider that the insurance expense of $4000 is paid personally by the employee,then the after-tax and after-insurance annual income would be only $32,000 as the insurance expense is paid separately and not directly deducted from annual after tax income.

=$28,000If we consider that the insurance expense of $4000 is paid personally by the employee,then the after-tax and after-insurance annual income would be only $32,000 as the insurance expense is paid separately and not directly deducted from annual after tax income.