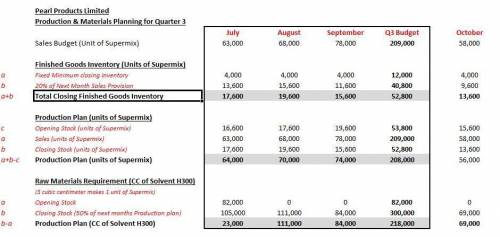

Pearl Products Limited of Shenzhen, China, manufactures and distributes toys throughout South East Asia. Three cubic centimeters (cc) of solvent H300 are required to manufacture each unit of Supermix, one of the company’s products. The company is now planning raw materials needs for the third quarter, the quarter in which peak sales of Supermix occur. To keep production and sales moving smoothly, the company has the following inventory requirements:a. The finished goods inventory on hand at the end of each month must be equal to 4,000 units of Supermix plus 20% of the next month’s sales. The finished goods inventory on June 30 is budgeted to be 16,600 units. b. The raw materials inventory on hand at the end of each month must be equal to one-half of the following month’s production needs for raw materials. The raw materials inventory on June 30 is budgeted to be 82,000 cc of solvent H300.c. The company maintains no work in process inventories. A sales budget for Supermix for the last six months of the year follows. Budgeted Sales in Units July 63,000 August 68,000 September 78,000 October 58,000 November 48,000 December 38,000Required: 1. Prepare a production budget for Supermix for the months July, August, September, and October. Budgeted unit sales July August September and OctoberTotal NeedsLess beginning inventoryRequired production3. Prepare a direct materials budget showing the quantity of solvent H300 to be purchased for July, August, and September, and for the quarter in total. Units of raw materials needed to meet production July August September Third QuarterDesired units of ending raw materials inventoryTotal units of raw materialsLess units of beginning raw materials inventoryUnits of raw materials to be purchased

Answers: 2

Another question on Business

Business, 22.06.2019 16:10

Omnidata uses the annualized income method to determine its quarterly federal income tax payments. it had $100,000, $50,000, and $90,000 of taxable income for the first, second, and third quarters, respectively ($240,000 in total through the first three quarters). what is omnidata's annual estimated taxable income for purposes of calculating the third quarter estimated payment?

Answers: 1

Business, 22.06.2019 21:10

The chromosome manufacturing company produces two products, x and y. the company president, jean mutation, is concerned about the fierce competition in the market for product x. she notes that competitors are selling x for a price well below chromosome's price of $13.50. at the same time, she notes that competitors are pricing product y almost twice as high as chromosome's price of $12.50.ms. mutation has obtained the following data for a recent time period: product x product y number of units 11,000 3,000 direct materials cost per unit $3.23 $3.09 direct labor cost per unit $2.22 $2.10 direct labor hours 10,000 3,500 machine hours 2,100 1,800 inspection hours 80 100 purchase orders 10 30ms. mutation has learned that overhead costs are assigned to products on the basis of direct labor hours. the overhead costs for this time period consisted of the following items: overhead cost item amount inspection costs $16,200 purchasing costs 8,000 machine costs 49,000 total $73,200using direct labor hours to allocate overhead costs determine the gross margin per unit for product x. choose the best answer from the list below.a. $1.93b. $3.12c. $7.38d. $2.43e. $1.73using activity-based costing for overhead allocation, determine the gross margin per unit for product y. choose best answer from list below.a. $10.07b. ($2.27)c. ($5.23)d. ($7.02)e. $7.02

Answers: 3

Business, 22.06.2019 22:00

He interest rate effect is the change in real gdp caused by the federal reserve adjusting target interest rates. is the change in consumer and investment spending due to changes in interest rates resulting from changes in the aggregate price level. is the change in exports and imports, resulting from changes in the interest rate caused by changes in the aggregate price level. is the change in investment spending and government purchases caused by changes in money demand. is the change in interest rates, caused by changes to government purchases.

Answers: 2

Business, 23.06.2019 00:00

Which of the following statements is correct? a major disadvantage of a partnership relative to a corporation is the fact that federal income taxes must be paid by the partners rather than by the firm itself. in a typical partnership, liability for other partners’ misdeeds is limited to the amount of a particular partner’s investment in the business.true in a limited partnership, the limited partners have voting control, while the general partner has operating control over the business, and the limited partners are individually responsible, on a pro rata basis, for the firm’s debts in the event of bankruptcy. partnerships have more difficulty attracting large amounts of capital than corporations because of such factors as unlimited liability, the need to reorganize when a partner dies, and the illiquidity of partnership interests.

Answers: 1

You know the right answer?

Pearl Products Limited of Shenzhen, China, manufactures and distributes toys throughout South East A...

Questions

Mathematics, 06.01.2022 16:00

Physics, 06.01.2022 16:00

Mathematics, 06.01.2022 16:00

Mathematics, 06.01.2022 16:00

English, 06.01.2022 16:00

Geography, 06.01.2022 16:00

Mathematics, 06.01.2022 16:00

Mathematics, 06.01.2022 16:00

Mathematics, 06.01.2022 16:00

English, 06.01.2022 16:00