Business, 22.04.2020 02:12 brainfreeze911ovksah

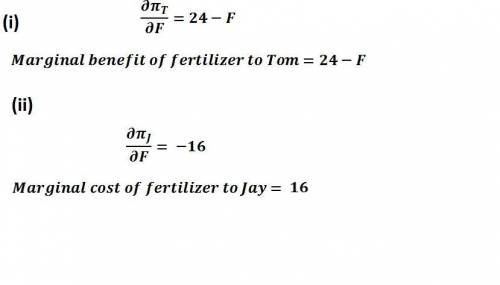

In a remote valley, two businesses share a waterway. Tom's Tomato Farm pumps water from a river and uses it to irrigate its fields. The used water eventually flows back into the river, carrying some of the fertilizer that Tom applies to his crops. Up to a certain point, more fertilizer helps increase Tom's harvest. Downstream, Jay's Riverview Campground offers campsites to interested vacationers. Fertilizer contamination of the river creates algae blooms that adversely affect Jay's business. The functions describing the profits of each establishment are pi_T(F) = 64 + 24F - .5F^2 pi_J(F) = 440 - 16F where the subscripts "T" and "J" refer to Tom's and Jays places of business, respectively. "F" represents the amount of fertilizer in the river generated by Tom a. Derive the functions representing (i) the marginal benefit of fertilizer to Tom and (ii) the marginal cost of fertilizer to Jay. Plot them on a graph b. Suppose that the existing law defines property rights that favor recreational users of waterways (e. g., campsites) at the expense of farmers. A campsite can sue a polluting farmer for prohibitive damages if any pollution takes place, unless the affected parties consent to an alternative agreement. Indicate (i) the amount of pollution that takes place in this scenario, and (ii) the profits ofTom and Jay. Assume that Jay has all the bargaining power (i. e., e captures the entire Coasian bargaining surplus). c. There exists a containment process for recapturing irrigation water in underground troughs and cleansing it of any leached fertilizer contaminants. This technology, which can be purchased for a cost of $X, would prevent Tom's operations from polluting the river at all (regardless of his choice of FO. Suppose property rights and bargaining power are defined as in (b). What is the most Tom would be willing to pay to obtain this new process?

Answers: 2

Another question on Business

Business, 21.06.2019 21:50

You have $22,000 to invest in a stock portfolio. your choices are stock x with an expected return of 11 percent and stock y with an expected return of 13 percent. if your goal is to create a portfolio with an expected return of 11.74 percent, how much money will you invest in stock x? in stock y?

Answers: 2

Business, 22.06.2019 02:30

Ds unlimited has the following transactions during august. august 6 purchases 58 handheld game devices on account from gamegirl, inc., for $140 each, terms 2/10, n/60. august 7 pays $340 to sure shipping for freight charges associated with the august 6 purchase. august 10 returns to gamegirl three game devices that were defective. august 14 pays the full amount due to gamegirl. august 23 sells 38 game devices purchased on august 6 for $160 each to customers on account. the total cost of the 38 game devices sold is $5,448.51. required: record the transactions of ds unlimited, assuming the company uses a perpetual inventory system. (if no entry is required for a transaction/event, select "no journal entry required" in the first account field. round your answers to 2 decimal places.)

Answers: 2

Business, 22.06.2019 05:00

Which of the following are considered needs? check all that apply

Answers: 1

Business, 22.06.2019 06:20

James albemarle created a trust fund at the beginning of 2016. the income from this fund will go to his son edward. when edward reaches the age of 25, the principal of the fund will be conveyed to united charities of cleveland. mr. albemarle specified that 75 percent of trustee fees are to be paid from principal. terry jones, cpa, is the trustee. james albemarle transferred cash of $500,000, stocks worth $400,000, and rental property valued at $250,000 to the trustee of this fund. immediately invested cash of $360,000 in bonds issued by the u.s. government. commissions of $7,900 are paid on this transaction. incurred permanent repairs of $9,000 so that the property can be rented. payment is made immediately. received dividends of $8,000. of this amount, $3,000 had been declared prior to the creation of the trust fund. paid insurance expense of $4,000 on the rental property. received rental income of $10,000. paid $8,000 from the trust for trustee services rendered. conveyed cash of $7,000 to edward albemarle.

Answers: 2

You know the right answer?

In a remote valley, two businesses share a waterway. Tom's Tomato Farm pumps water from a river and...

Questions

History, 24.05.2021 01:00

Mathematics, 24.05.2021 01:00

Social Studies, 24.05.2021 01:00

English, 24.05.2021 01:00

History, 24.05.2021 01:00

Mathematics, 24.05.2021 01:00

Mathematics, 24.05.2021 01:00

Mathematics, 24.05.2021 01:00

Mathematics, 24.05.2021 01:00

English, 24.05.2021 01:00

World Languages, 24.05.2021 01:00

Physics, 24.05.2021 01:00