Business, 22.04.2020 02:08 marahsenno

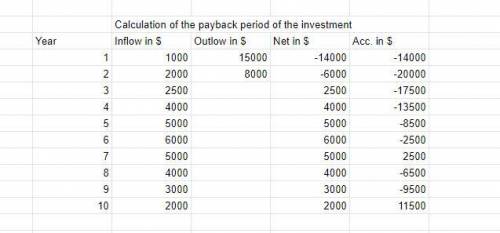

The management of Unter Corporation, an architectural design firm, is considering an investment with the following cash flows: Year Investment Cash Inflow 1 $ 15,000 $ 1,000 2 $ 8,000 $ 2,000 3 $ 2,500 4 $ 4,000 5 $ 5,000 6 $ 6,000 7 $ 5,000 8 $ 4,000 9 $ 3,000 10 $ 2,000 Required: 1. Determine the payback period of the investment. 2. Would the payback period be affected if the cash inflow in the last year were several times as large

Answers: 1

Another question on Business

Business, 22.06.2019 12:10

Profits from using currency options and futures.on july 2, the two-month futures rate of the mexican peso contained a 2 percent discount (unannualized). there was a call option on pesos with an exercise price that was equal to the spot rate. there was also a put option on pesos with an exercise price equal to the spot rate. the premium on each of these options was 3 percent of the spot rate at that time. on september 2, the option expired. go to the oanda.com website (or any site that has foreign exchange rate quotations) and determine the direct quote of the mexican peso. you exercised the option on this date if it was feasible to do so. a. what was your net profit per unit if you had purchased the call option? b. what was your net profit per unit if you had purchased the put option? c. what was your net profit per unit if you had purchased a futures contract on july 2 that had a settlement date of september 2? d. what was your net profit per unit if you sold a futures contract on july 2 that had a settlement date of september 2

Answers: 1

Business, 22.06.2019 12:50

You are working on a bid to build two city parks a year for the next three years. this project requires the purchase of $249,000 of equipment that will be depreciated using straight-line depreciation to a zero book value over the three-year project life. ignore bonus depreciation. the equipment can be sold at the end of the project for $115,000. you will also need $18.000 in net working capital for the duration of the project. the fixed costs will be $37000 a year and the variable costs will be $148,000 per park. your required rate of return is 14 percent and your tax rate is 21 percent. what is the minimal amount you should bid per park? (round your answer to the nearest $100) (a) $214,300 (b) $214,100 (c) $212,500 (d) $208,200 (e) $208,400

Answers: 3

Business, 22.06.2019 15:00

Why entrepreneurs start businesses. a) monopolistic competition b) perfect competition c) sole proprietorship d) profit motive

Answers: 1

You know the right answer?

The management of Unter Corporation, an architectural design firm, is considering an investment with...

Questions

Social Studies, 25.11.2020 20:30

French, 25.11.2020 20:30

History, 25.11.2020 20:30

Mathematics, 25.11.2020 20:30

Mathematics, 25.11.2020 20:30

Computers and Technology, 25.11.2020 20:30

Chemistry, 25.11.2020 20:30

Mathematics, 25.11.2020 20:30

Biology, 25.11.2020 20:30

Mathematics, 25.11.2020 20:30

Social Studies, 25.11.2020 20:30

English, 25.11.2020 20:30

Mathematics, 25.11.2020 20:30

![\left[\begin{array}{ccccc}Year&Inflow&Outflow&Net&Acc\\1&1,000&15,000&-14,000&-14,000\\2&2,000&8,000&-6,000&-20,000\\3&2,500&&2,500&-17,500\\4&4,000&&4,000&-13,500\\5&5,000&&5,000&-8,500\\6&6,000&&6,000&-2,500\\7&5,000&&5,000&2,500\\8&4,000&&4,000&6,500\\9&3,000&&3,000&9,500\\10&2,000&&2,000&11,500\\\end{array}\right]](/tpl/images/0617/0175/d2cd3.png)