Business, 22.04.2020 04:19 silvermansachs9189

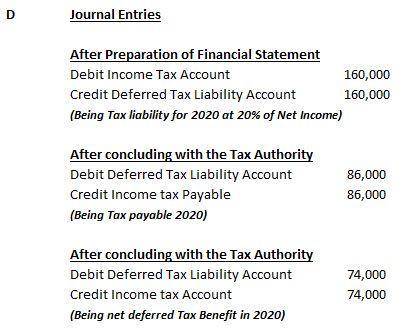

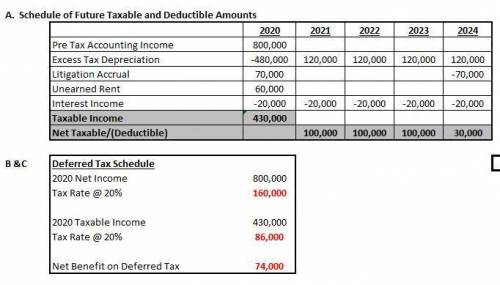

The following differences enter into the reconciliation of financial income and taxable income of Abbott Company for the year ended December 31, 2020, its first year of operations. The enacted income tax rate is 20% for all years. Pretax accounting income $800,000 Excess tax depreciation (480,000) Litigation accrual 70,000 Unearned rent revenue deferred on the books but appropriately recognized in taxable income 60,000 Interest income from New York municipal bonds (20,000) Taxable income $430,000 1. Excess tax depreciation will reverse equally over a four-year period, 2021-2024. 2. It is estimated that the litigation liability will be paid in 2024. 3. Rent revenue will be recognized during the last year of the lease, 2024. 4. Interest revenue from the New York bonds is expected to be $20,000 each year until their maturity at the end of 2024. Instructions (a) Prepare a schedule of future taxable and (deductible) amounts. (b) Prepare a schedule of the deferred tax (asset) and liability at the end of 2020. (c) Since this is the first year of operations, there is no beginning deferred tax asset or liability. Compute the net deferred tax expense (benefit). (d) Prepare the journal entry to record income tax expense, deferred taxes, and the income taxes payable for 2020

Answers: 2

Another question on Business

Business, 22.06.2019 12:40

Evan company reports net income of $232,000 each year and declares an annual cash dividend of $100,000. the company holds net assets of $2,130,000 on january 1, 2017. on that date, shalina purchases 40 percent of evan's outstanding common stock for $1,066,000, which gives it the ability to significantly influence evan. at the purchase date, the excess of shalina’s cost over its proportionate share of evan’s book value was assigned to goodwill. on december 31, 2019, what is the investment in evan company balance (equity method) in shalina’s financial records?

Answers: 2

Business, 22.06.2019 20:50

Swathmore clothing corporation grants its customers 30 days' credit. the company uses the allowance method for its uncollectible accounts receivable. during the year, a monthly bad debt accrual is made by multiplying 3% times the amount of credit sales for the month. at the fiscal year-end of december 31, an aging of accounts receivable schedule is prepared and the allowance for uncollectible accounts is adjusted accordingly. at the end of 2012, accounts receivable were dollar 586.000 and the allowance account had a credit balance of dollar 50,000. accounts receivable activity for 2013 was as follows: the company's controller prepared the following aging summary of year-end accounts receivable: prepare a summary journal entry to record the monthly bad debt accrual and the write-offs during the year. (if no entry is required for a particular event, select "no journal entry required" in the first account field.) prepare the necessary year-end adjusting entry for bad debt expense. (if no entry is required for an event, select "no journal entry required" in the first account field.) what is total bad debt expense for 2013? calculate the amount of accounts receivable that would appear in the 2013 balance sheet?

Answers: 2

Business, 22.06.2019 22:30

Ski powder resort ends its fiscal year on april 30. the business adjusts its accounts monthly, but closes them only at year-end (april 30). the resort's busy season is from december 1 through march 31. adrian pride, the resort's chief financial officer, the museums a close watch on lift ticket revenue and cash. the balances of these accounts at the end of each of the last five months are as follows:

Answers: 3

Business, 23.06.2019 00:00

Todd and jim learned that in building a business plan, it was important for them to:

Answers: 1

You know the right answer?

The following differences enter into the reconciliation of financial income and taxable income of Ab...

Questions

Biology, 12.11.2019 03:31

History, 12.11.2019 03:31

Chemistry, 12.11.2019 03:31

Health, 12.11.2019 03:31

Geography, 12.11.2019 03:31

Arts, 12.11.2019 03:31

Mathematics, 12.11.2019 03:31

Mathematics, 12.11.2019 03:31

Biology, 12.11.2019 03:31