Business, 24.04.2020 04:54 edsimms21111

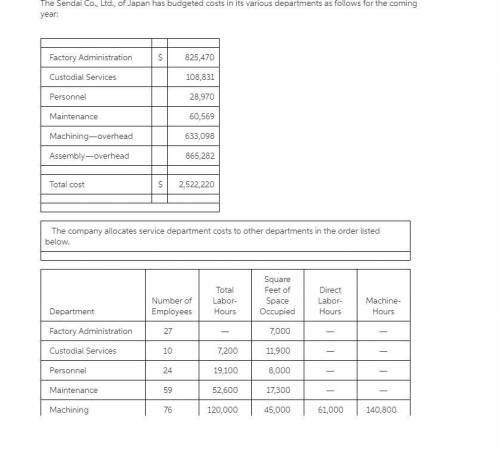

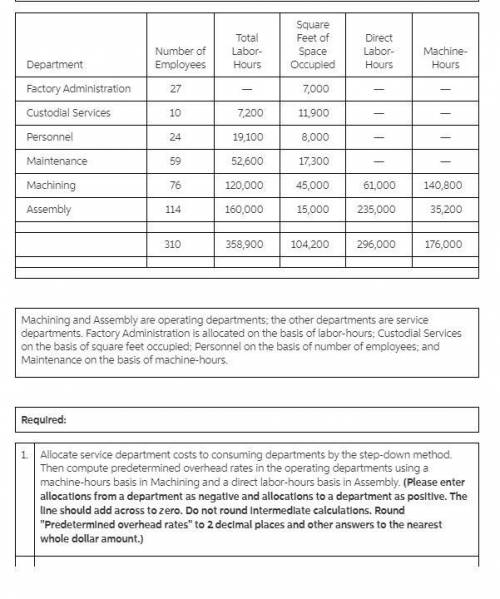

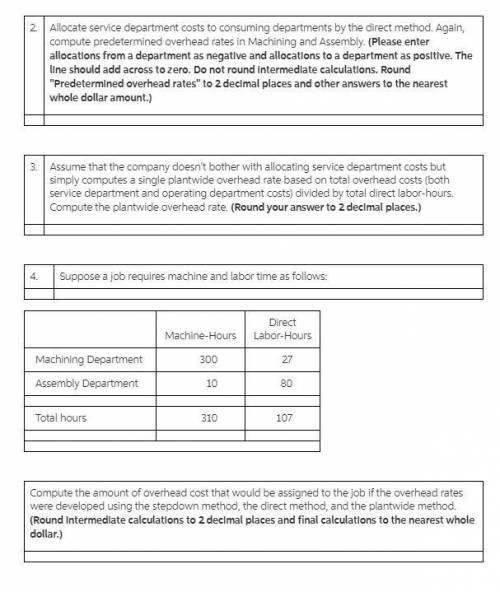

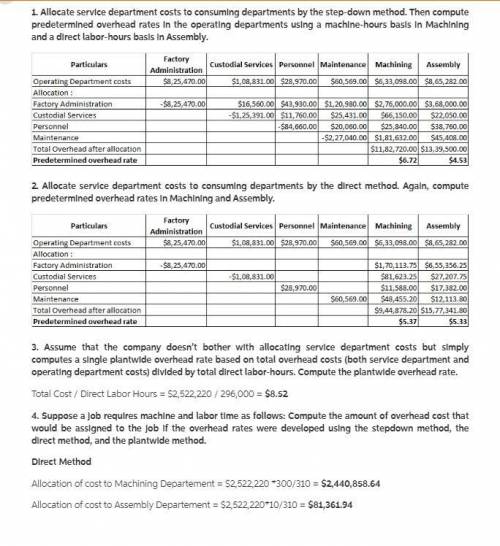

Achining and Assembly are operating departments; the other departments are service departments. Factory Administration is allocated based on labor-hours; Custodial Services based on square feet occupied; Personnel based on number of employees; and Maintenance based on machine-hours. Required: 1. Allocate service department costs to consuming departments by the step-down method. Then compute predetermined overhead rates in the operating departments using machine-hours as the allocation base in Machining and direct labor-hours as the allocation base in Assembly. 2. Repeat (1) above, this time using the direct method. Again compute predetermined overhead rates in Machining and Assembly. 3. Assume that the company doesn’t bother with allocating service department costs but simply computes a single plantwide overhead rate that divides the total overhead costs (both service department and operating department costs) by the total direct labor-hours. Compute the plantwide overhead rate. 4. Suppose a job requires machine and labor time as follows:

Answers: 2

Another question on Business

Business, 22.06.2019 08:00

Shrieves casting company is considering adding a new line to its product mix, and the capital budgeting analysis is being conducted by sidney johnson, a recently graduated mba. the production line would be set up in unused space in the main plant. the machinery’s invoice price would be approximately $200,000, another $10,000 in shipping charges would be required, and it would cost an additional $30,000 to install the equipment. the machinery has an economic life of 4 years, and shrieves has obtained a special tax ruling that places the equipment in the macrs 3-year class. the machinery is expected to have a salvage value of $25,000 after 4 years of use. the new line would generate incremental sales of 1,250 units per year for 4 years at an incremental cost of $100 per unit in the first year, excluding depreciation. each unit can be sold for $200 in the first year. the sales price and cost are both expected to increase by 3% per year due to inflation. further, to handle the new line, the firm’s net working capital would have to increase by an amount equal to 12% of sales revenues. the firm’s tax rate is 40%, and its overall weighted average cost of capital, which is the risk-adjusted cost of capital for an average project (r), is 10%. define “incremental cash flow.” (1) should you subtract interest expense or dividends when calculating project cash flow?

Answers: 1

Business, 22.06.2019 09:50

Beck company had the following accounts and balances at the end of the year. what is net income or net loss for the year? cash $ 74 comma 000 accounts payable $12,000 common stock $21,000 dividends $12,000 operating expenses $ 13 comma 000 accounts receivable $ 49 comma 000 inventory $ 47 comma 000 longminusterm notes payable $33,000 revenues $ 91 comma 000 salaries payable $ 30 comma 000

Answers: 1

Business, 22.06.2019 11:00

Why does an organization prepare a balance sheet? a. to reveal what the organization owns and owes at a point in time b. to reveal how well the company utilizes its cash c. to calculate retained earnings for a given accounting period d. to calculate gross profit for a given accounting period

Answers: 3

Business, 23.06.2019 01:30

What is the minimum educational requirement for a pediatric psychopharmacologist? a. md b. phd c. bachelors in medicine d. masters in medicine e. psyd

Answers: 1

You know the right answer?

Achining and Assembly are operating departments; the other departments are service departments. Fact...

Questions

French, 28.05.2021 02:20

Physics, 28.05.2021 02:20

Chemistry, 28.05.2021 02:20

Mathematics, 28.05.2021 02:20

Social Studies, 28.05.2021 02:20

Social Studies, 28.05.2021 02:20