Business, 25.04.2020 03:20 tashkynmurat

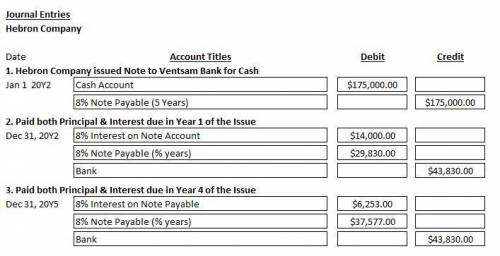

Entries for Installment Note Transactions On January 1, 20Y2, Hebron Company issued a $175,000, five-year, 8% installment note to Ventsam Bank. The note requires annual payments of $43,830, beginning on December 31, 20Y2. Journalize the entries to record the following: 20Y2 Jan. 1. Issued the note for cash at its face amount. Dec. 31. Paid the annual payment on the note, which consisted of interest of $14,000 and principal of $29,830. 20Y5 Dec. 31. Paid the annual payment on the note, included $6,253 of interest. The remainder of the payment reduced the principal balance on the note. Issued the note for cash at its face amount. If an amount box does not require an entry, leave it blank. 20Y2 Jan. 1 Paid the annual payment on the note, which consisted of interest of $14,000 and principal of $29,830. If an amount box does not require an entry, leave it blank. 20Y2 Dec. 31 Paid the annual payment on the note, included $6,253 of interest. The remainder of the payment reduced the principal balance on the note. If an amount box does not require an entry, leave it blank. 20Y5 Dec. 31

Answers: 1

Another question on Business

Business, 22.06.2019 06:40

After the 2008 recession, the amount of reserves in the us banking system increased. because of federal reserve actions, required reserves increased from $44 billion to $60 billion. however, banks started holding more reserves than required. by january 2009, banks were holding $900 billion in excess reserves. the federal reserve started paying interest on the excess reserves that the banks held. what possible impact will these unused reserves have on the economy?

Answers: 1

Business, 22.06.2019 11:30

Given the following information about the closed economy of brittania, what is the level of investment spending and private savings, and what is the budget balance? assume there are no government transfers. gdp=$1180.00 million =$510.00 million =$380.00 million =$280.00 million

Answers: 3

Business, 22.06.2019 15:30

Calculate the required rate of return for climax inc., assuming that (1) investors expect a 4.0% rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 5.0%, (4) the firm has a beta of 2.30, and (5) its realized rate of return has averaged 15.0% over the last 5 years. do not round your intermediate calculations.

Answers: 3

Business, 22.06.2019 19:20

Garrett is an executive vice president at samm hardware. he researches a proposal by a larger company, maximum hardware, to combine the two companies. by analyzing past performance, conducting focus groups, and interviewing maximum employees, garrett concludes that maximum has poor profit margins, sells shoddy merchandise, and treats customers poorly. what actions should garrett and samm hardware take? a. turn down the acquisition offer and prepare to resist a hostile takeover. b. attempt a friendly merger and use managerial hubris to improve results at maximum. c. welcome the acquisition and use knowledge transfer to impart sam hardware's management practices. d. do nothing; the two companies cannot combine without samm hardware's explicit consent.

Answers: 1

You know the right answer?

Entries for Installment Note Transactions On January 1, 20Y2, Hebron Company issued a $175,000, five...

Questions

Mathematics, 14.05.2021 17:00

Mathematics, 14.05.2021 17:00

Biology, 14.05.2021 17:00

Mathematics, 14.05.2021 17:00

English, 14.05.2021 17:00

Mathematics, 14.05.2021 17:00

History, 14.05.2021 17:00

Mathematics, 14.05.2021 17:00

Biology, 14.05.2021 17:00

Mathematics, 14.05.2021 17:00