Business, 25.04.2020 04:48 frankgore8496

The following selected transactions are from King Company.

Year 1

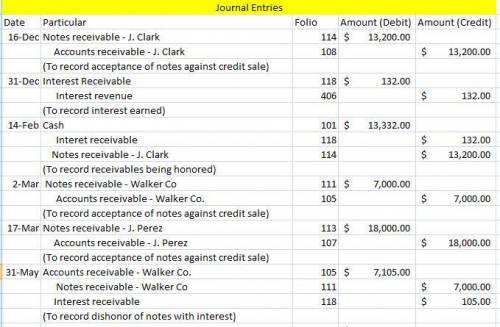

Dec. 16 Accepted a $13,200, 60-day, 12% note in granting Jean Clark a time extension on his past-due account receivable.

31 Made an adjusting entry to record the accrued interest on the Clark note.

Year 2

Feb. 14 Received Clark’s payment of principal and interest on the note dated December 16.

Mar. 2 Accepted a $7,000, 6%, 90-day note in granting a time extension on the past-due account receivable from Walker Co.

17 Accepted a $18,000, 30-day, 7% note in granting Juan Perez a time extension on her past-due account receivable.

Apr. 16 Perez dishonored her note.

May 31 Walker Co. dishonored its note.

Aug. 7 Accepted a $16,000, 90-day, 6% note in granting a time extension on the past-due account receivable of Taylor Co.

Sep. 3 Accepted a $17,400, 60-day, 10% note in granting Tony Turner a time extension on his past-due account receivable.

Nov. 2 Received payment of principal plus interest from Turner for the September 3 note.

Nov. 5 Received payment of principal plus interest from Taylor for the August 7 note.

Dec. 1

Wrote off the Perez account against the Allowance for Doubtful Accounts.

2) March 2 Mar. 2 Accepted an $7,000, 6%, 90-day note in granting a time extension on the past-due account receivable from Walker Co.

3) Mar. 17 Accepted a $18,000, 30-day, 7% note in granting Juan Perez a time extension on her past-due account receivable.

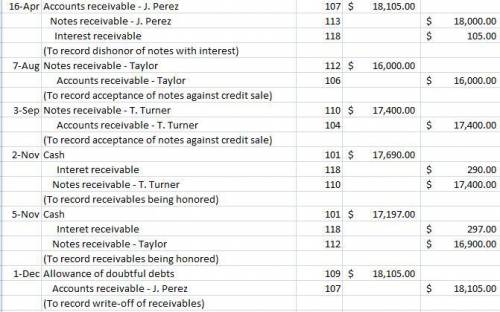

4) April 16 Apr. 16 Perez dishonored her note.

5) May 31 Walker Co. dishonored its note.

6) Aug. 7 Accepted a(n) $16,000, 90-day, 6% note in granting a time extension on the past-due account receivable of Taylor Co.

7) Sept. 3 Accepted a $17,400, 60-day, 10% note in granting Tony Turner a time extension on his past-due account receivable.

8) Nov. 2 Received payment of principal plus interest from Turner for the September 3 note.

9) Nov. 5 Received payment of principal plus interest from Taylor for the August 7 note.

10) Dec. 1 Wrote off the Perez account against Allowance for Doubtful Accounts. No additional interest was accrued.

Options for General Journal

000: No journal entry required

101: Cash

103: Account receivable - Other

104: Accounts receivable - T. Turner

105: Accounts receivable - Walker Co.

106: Accounts receivable - Taylor

107: Accounts receivable - J. Perez

108: Accounts receivable - J. Clark

109: Allowance for doubtful accounts

110: Notes receivable - T. Turner

111: Notes receivable - Walker Co.

112: Notes receivable - Taylor

113: Notes receivable - J. Perez

114: Notes receivable - J. Clark

118: Interest receivable

120: Merchandise inventory

201: Accounts payable - T. Turner

202: Accounts payable - Walker Co.

203: Accounts payable - Taylor

204: Accounts payable - J. Clark

209: Salaries payable

226: Unearned fees

301: Owner's Capital

302: Owner's withdrawals

403: Sales

404: Sales returns and allowances

405: Sales discounts

406: Interest revenue

600: Cost of goods sold

602: Purchases

603: Purchases returns and allowances

604: Purchases discounts

640: Rent expense

652: Freight-in

655: Bad debts expense

660: Delivery expense

665: Interest expense

700: Income summary

Answers: 3

Another question on Business

Business, 21.06.2019 20:00

When an interest-bearing note comes due and is uncollectible, the journal entry includes debiting

Answers: 3

Business, 22.06.2019 14:40

In the fall of 2008, aig, the largest insurance company in the world at the time, was at risk of defaulting due to the severity of the global financial crisis. as a result, the u.s. government stepped in to support aig with large capital injections and an ownership stake. how would this affect, if at all, the yield and risk premium on aig corporate debt?

Answers: 3

Business, 22.06.2019 19:40

The following cost and inventory data are taken from the accounting records of mason company for the year just completed: costs incurred: direct labor cost $ 90,000 purchases of raw materials $ 134,000 manufacturing overhead $ 205,000 advertising expense $ 45,000 sales salaries $ 101,000 depreciation, office equipment $ 225,000 beginning of the year end of the year inventories: raw materials $ 8,100 $ 10,300 work in process $ 5,900 $ 21,000 finished goods $ 77,000 $ 25,800 required: 1. prepare a schedule of cost of goods manufactured. 2. prepare the cost of goods sold section of mason company’s income statement for the year.

Answers: 3

You know the right answer?

The following selected transactions are from King Company.

Year 1

Dec. 16...

Year 1

Dec. 16...

Questions

Engineering, 18.02.2021 09:10

Mathematics, 18.02.2021 09:10

Chemistry, 18.02.2021 09:10

History, 18.02.2021 09:10

Chemistry, 18.02.2021 09:10

Biology, 18.02.2021 09:10

Social Studies, 18.02.2021 09:10

Mathematics, 18.02.2021 09:10

Chemistry, 18.02.2021 09:10

Advanced Placement (AP), 18.02.2021 09:10

Physics, 18.02.2021 09:10

English, 18.02.2021 09:10

Mathematics, 18.02.2021 09:10