Business, 25.04.2020 04:53 cynthiauzoma367

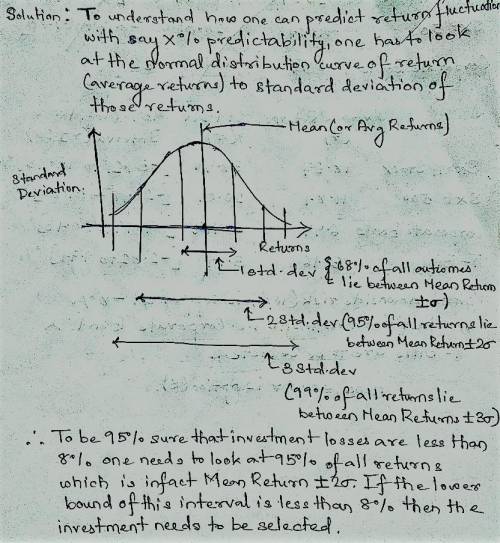

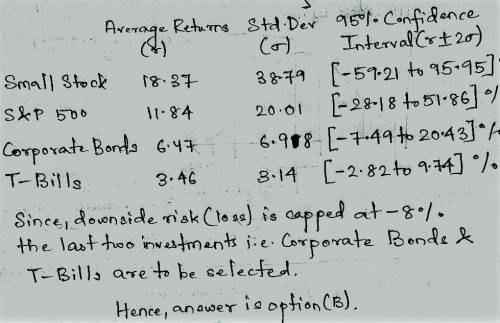

You are choosing between these four investments and you want to be 95% certain that you do not lose more than 8.00 % on your investment. Which investments could you choose?

Small Stocks S&P 500 Corporate Bonds T-Bills

Average return 18.37% 11.84% 6.47% 3.46%

Standard Deviation 38.79% 20.01% 6.98% 3.14%

of returns

(Select the best choice below.)

Which of the following have the lower bound of the estimated range greater than

18.00 %?

A. All of the Investments

B. T-Bills only

C. Long-term Government of Canada Bonds and T-Bills

D. S&P TSX and S&P 500 in CAD

E. Long-term Government of Canada Bonds and S&P 500 in CAD

Answers: 1

Another question on Business

Business, 21.06.2019 18:30

What is the communication process? why isnt it possible to communicate without using all the elements in the communication process?

Answers: 3

Business, 22.06.2019 09:50

Beck company had the following accounts and balances at the end of the year. what is net income or net loss for the year? cash $ 74 comma 000 accounts payable $12,000 common stock $21,000 dividends $12,000 operating expenses $ 13 comma 000 accounts receivable $ 49 comma 000 inventory $ 47 comma 000 longminusterm notes payable $33,000 revenues $ 91 comma 000 salaries payable $ 30 comma 000

Answers: 1

Business, 22.06.2019 14:00

Bayside coatings company purchased waterproofing equipment on january 2, 20y4, for $190,000. the equipment was expected to have a useful life of four years and a residual value of $9,000. instructions: determine the amount of depreciation expense for the years ended december 31, 20y4, 20y5, 20y6, and 20y7, by (a) the straight-line method and (b) the double-declining-balance method. also determine the total depreciation expense for the four years by each method. depreciation expense year straight-line method double-declining-balance method 20y4 $ $ 20y5 20y6 20y7 total $

Answers: 3

Business, 22.06.2019 14:40

Increases in output and increases in the inflation rate have been linked to

Answers: 2

You know the right answer?

You are choosing between these four investments and you want to be 95% certain that you do not lose...

Questions

History, 28.01.2021 19:50

Mathematics, 28.01.2021 19:50

Mathematics, 28.01.2021 19:50

Mathematics, 28.01.2021 19:50

Mathematics, 28.01.2021 19:50

Biology, 28.01.2021 19:50

Mathematics, 28.01.2021 19:50

Mathematics, 28.01.2021 19:50