Business, 06.05.2020 07:09 jamessmith86

You have been asked by a client to review the records of Metlock Company, a small manufacturer of precision tools and machines. Your client is interested in buying the business, and arrangements have been made for you to review the accounting records. Your examination reveals the following information.

1. Metlock Company commenced business on April 1, 2015, and has been reporting on a fiscal year ending March 31. The company has never been audited, but the annual statements prepared by the bookkeeper reflect the following income before closing and before deducting income taxes.

Year Ended March 31 Income Before Taxes

2016 $89,500

2017 139,250

2018 129,475

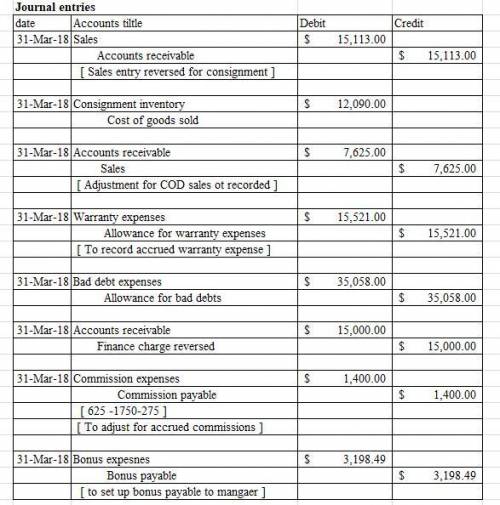

2. A relatively small number of machines have been shipped on consignment. These transactions have been recorded as ordinary sales and billed as such. On March 31 of each year, machines billed and in the hands of consignees amounted to:

2016 $8,125

2017 none

2018 6,988

Sales price was determined by adding 25% to cost. Assume that the consigned machines are sold the following year.

3. On March 30, 2017, two machines were shipped to a customer on a C. O.D. basis. The sale was not entered until April 5, 2017, when cash was received for $7,625. The machines were not included in the inventory at March 31, 2017. (Title passed on March 30, 2017.)

4. All machines are sold subject to a 5-year warranty. It is estimated that the expense ultimately to be incurred in connection with the warranty will amount to 1/2 of 1% of sales. The company has charged an expense account for warranty costs incurred.

Sales per books and warranty costs were as follows.

Warranty Expense for Sales Made in

Year Ended March 31 Sales 2016 2017 2018 Total

2016 $1,175,000 $950 $950

2017 1,262,500 450 $1,638 2,088

2018 2,243,750 400 2,025 $2,388 4,813

5. Bad debts have been recorded on a direct write-off basis. Experience of similar enterprises indicates that losses will approximate 1% of receivables. Bad debts written off were:

Bad Debts Incurred on Sales Made in

2016 2017 2018 Total Bad Debt Expense Based on 1% of Receivables

2016 $938 $938 $2,917

2017 1,000 $650 1,650 3,196

2018 438 2,250 $2,125 4,813 5,573

6. The bank deducts 6% on all contracts financed. Of this amount, 1/2% is placed in a reserve to the credit of Metlock Company that is refunded to Metlock as finance contracts are paid in full. (Thus, Metlock should have a receivable for these payments and should record revenue when the net balance is remitted each year.) The reserve established by the bank has not been reflected in the books of Metlock. The excess of credits over debits (net increase) to the reserve account with Metlock on the books of the bank for each fiscal year were as follows.

2016 $3,750

2017 4,875

2018 6,375

$15,000

7. Commissions on sales have been entered when paid. Commissions payable on March 31 of each year were as follows.

2016 $1,750

2017 1,125

2018 1,400

8. A review of the corporate minutes reveals the manager is entitled to a bonus of 1% of the income before deducting income taxes and the bonus. The bonuses have never been recorded or paid.

Required:

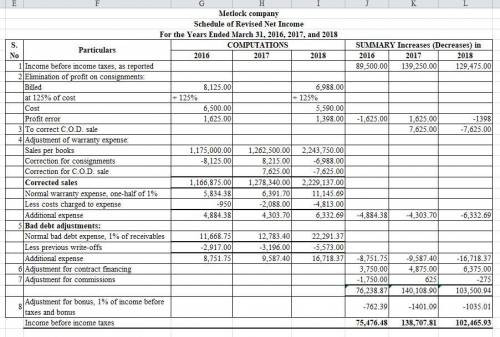

1. Present a schedule showing the revised income before income taxes for each of the years ended March 31, 2016, 2017, and 2018. (Enter negative amounts using either a negative sign preceding the number e. g. -15,000 or parentheses e. g. (15,000). Round answers to the nearest whole dollar, e. g. 5,275.)

Answers: 3

Another question on Business

Business, 21.06.2019 13:00

How did mussolini use the fear of communism to strengthen his hold over italy?

Answers: 2

Business, 22.06.2019 07:30

Select the correct answer. sarah works in a coffee house where she is responsible for keying in customer orders. a customer orders snacks and coffee, but later, cancels th snacks, saying she wants only coffee. at the end of the day, sarah finds that there is a mismatch in the snack items ordered. which term suggest data has been violated? a. security b. integrity c. adding d. reliability e. reporting

Answers: 3

Business, 22.06.2019 17:50

Abc factory produces 24,000 units. the cost sheet gives the following information: direct materials rs. 1,20,000direct labour rs. 84,000variable overheads rs. 48,000semi variable overheads rs. 28,000fixed overheads rs. 80,000total cost rs. 3,60,000presently the product is sold at rs. 20 per unit.the management proposes to increase the production by 3,000 units for sales in the foreign market . it is estimated that semi variable overheads will increase by rs. 1,000. but the product will be sold at rs. 14 per unit in the foreign market. however, no additional capital expenditure will be incurredq-1. what is present profit of the company ? q-2. what is proposed profit of the company in new market? q-3.what is suggestion for new makret proposal whether proposal accept or not

Answers: 1

Business, 22.06.2019 19:30

Anew firm is developing its business plan. it will require $615,000 of assets, and it projects $450,000 of sales and $355,000 of operating costs for the first year. management is reasonably sure of these numbers because of contracts with its customers and suppliers. it can borrow at a rate of 7.5%, but the bank requires it to have a tie of at least 4.0, and if the tie falls below this level the bank will call in the loan and the firm will go bankrupt. what is the maximum debt ratio the firm can use? (hint: find the maximum dollars of interest, then the debt that produces that interest, and then the related debt ratio.)a. 41.94%b. 44.15%c. 46.47%d. 48.92%e. 51.49%

Answers: 3

You know the right answer?

You have been asked by a client to review the records of Metlock Company, a small manufacturer of pr...

Questions

Mathematics, 11.02.2021 02:00

Mathematics, 11.02.2021 02:00

Biology, 11.02.2021 02:00

Mathematics, 11.02.2021 02:00

Biology, 11.02.2021 02:00

Biology, 11.02.2021 02:00

Social Studies, 11.02.2021 02:00

Social Studies, 11.02.2021 02:00

Mathematics, 11.02.2021 02:00

Arts, 11.02.2021 02:00

Mathematics, 11.02.2021 02:00

Chemistry, 11.02.2021 02:00

Mathematics, 11.02.2021 02:00