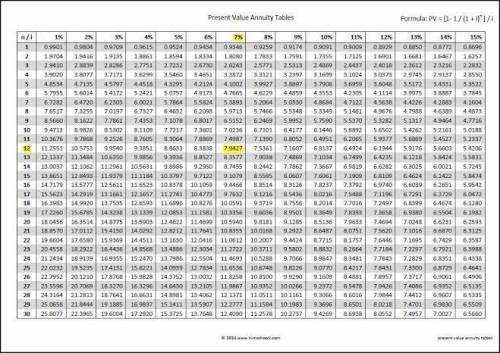

Dobson Contractors is considering buying equipment at a cost of $75,000. The equipment is expected to generate cash flows of $15,000 per year for eight years and can be sold at the end of eight years for $5,000. Interest is at 12%. Assume the equipment would be paid for on the first day of year one, but that all other cash flows occur at the end of the year. Ignore income tax considerations. Determine the net present value of the cash flows and if Dobson should purchase the machine. a. $194,256 negative net present value of the cash flows. Based on present value considerations, Dobson Construction should not buy the machine. b. $194,256 positive net present value of the cash flows. Based on present value considerations, Dobson Construction should buy the machine. c. $1,534 negative net present value of the cash flows. Based on present value considerations, Dobson Construction should not buy the machine. d. $1,534 positive net present value of the cash flows. Based on present value considerations, Dobson Construction should buy the machine.

Answers: 1

Another question on Business

Business, 21.06.2019 20:20

Aproduction order quantity problem has a daily demand rate = 10 and a daily production rate = 50. the production order quantity for this problem is approximately 612 units. what is the average inventory for this problem?

Answers: 1

Business, 21.06.2019 21:00

John novosel was employed by nationwide insurance company for fifteen years. novosel had been a model employee and, at the time of discharge, was a district claims manager and a candidate for the position of division claims manager. during novosel's fifteenth year of employment, nationwide circulated a memorandum requesting the participation of all employees in an effort to lobby the pennsylvania state legislature for the passage of a certain bill before the body. novosel, who had privately indicated his disagreement with nationwide's political views, refused to lend his support to the lobby, and his employment with nationwide was terminated. novosel brought two separate claims against nationwide, arguing, first, that his discharge for refusing to lobby the state legislature on behalf of nationwide constituted the tort of wrongful discharge in that it was arbitrary, malicious, and contrary to public policy. novosel also contended that nationwide breached an implied contract guaranteeing continued employment so long as his job performance was satisfactory. what decision as to each claim?

Answers: 3

Business, 22.06.2019 04:00

The simple interest in a loan of $200 at 10 percent interest per year is

Answers: 2

Business, 22.06.2019 08:30

Most angel investors expect a return on investment of question options: 20% to 25% over 5 years. 15% to 20% over 5 years. 75% over 10 years. 100% over 5 years.

Answers: 1

You know the right answer?

Dobson Contractors is considering buying equipment at a cost of $75,000. The equipment is expected t...

Questions

Mathematics, 23.04.2020 01:08

Mathematics, 23.04.2020 01:09

Mathematics, 23.04.2020 01:09

History, 23.04.2020 01:09

History, 23.04.2020 01:09

Physics, 23.04.2020 01:09

English, 23.04.2020 01:09