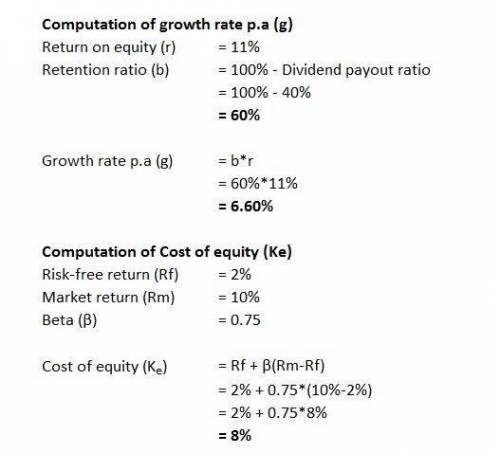

Suppose YUCK! (YUCK), the parent company of many fast food chains that compete with McDonalds, currently has a dividend payout ratio of 40%. Its beta is 0.75 and its current dividend per share is $1.44 per year. Suppose YUCK has a return on equity of 11% and the risk-free rate is 2% while the expected annual return on the S&P 500 is 10%.

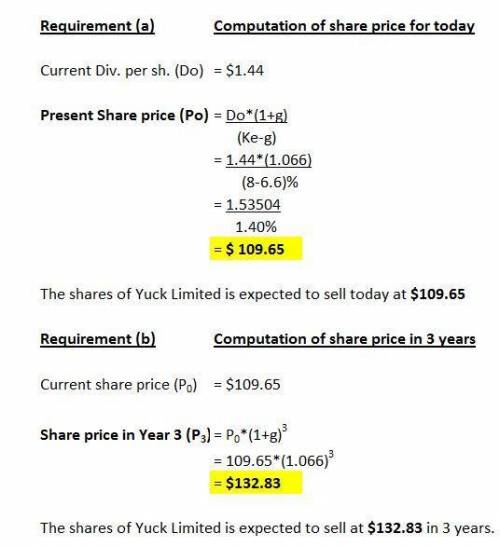

(a) At what price do you expect a share of YUCK to sell for today?

(b) At what price do you expect YUCK to sell in three years?

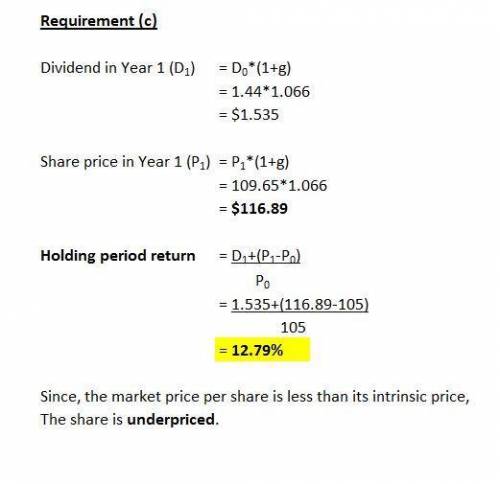

(c) It turns out that YUCK currently sells for $105. If you expect that YUCK’s market price will equal its intrinsic value 1 year from now, what is your expected 1 year holding period return on YUCK stock? What does this imply about under/overpricing and alphas?

Answers: 2

Another question on Business

Business, 21.06.2019 20:30

Resources that are valuable but not rare can be categorized asanswers: organizational weaknesses.distinctive competencies.organizational strengths.complementary resources and capabilities.

Answers: 1

Business, 22.06.2019 09:00

Asap describe three different expenses associated with restaurants. choose one of these expenses, and discuss how a manager could handle this expense.

Answers: 1

Business, 22.06.2019 11:00

%of the world's population controls approximately % of the world's finances (the sum of gross domestic products)" quizlket

Answers: 1

Business, 22.06.2019 16:50

Slow ride corp. is evaluating a project with the following cash flows: year cash flow 0 –$12,000 1 5,800 2 6,500 3 6,200 4 5,100 5 –4,300 the company uses a 11 percent discount rate and an 8 percent reinvestment rate on all of its projects. calculate the mirr of the project using all three methods using these interest rates.

Answers: 2

You know the right answer?

Suppose YUCK! (YUCK), the parent company of many fast food chains that compete with McDonalds, curre...

Questions

Mathematics, 20.05.2021 22:10

Advanced Placement (AP), 20.05.2021 22:10

Mathematics, 20.05.2021 22:10

Mathematics, 20.05.2021 22:10

Mathematics, 20.05.2021 22:10

Mathematics, 20.05.2021 22:10

Mathematics, 20.05.2021 22:10

Mathematics, 20.05.2021 22:10

Mathematics, 20.05.2021 22:10

English, 20.05.2021 22:10

History, 20.05.2021 22:10