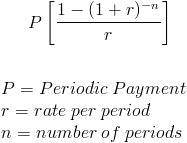

G Gustavo is considering an investment proposal that requires an initial investment of $91,100, has predicted cash inflows of $30,000 per year for four years, and no residual value. At a discount rate of 10 percent, the project’s net present value is: (use the tables provided in these notes; round all calculations to the nearest dollar)

Answers: 1

Another question on Business

Business, 22.06.2019 10:10

conquest, inc. produces a special kind of light-weight, recreational vehicle that has a unique design. it allows the company to follow a cost-plus pricing strategy. it has $9,000,000 of average assets, and the desired profit is a 10% return on assets. assume all products produced are sold. additional data are as follows: sales volume 1000 units per year; variable costs $1000 per unit; fixed costs $4,000,000 per year; using the cost-plus pricing approach, what should be the sales price per unit?

Answers: 2

Business, 22.06.2019 12:20

If jobs have been undercosted due to underallocation of manufacturing overhead, then cost of goods sold (cogs) is too low and which of the following corrections must be made? a. decrease cogs for double the amount of the underallocation b. increase cogs for double the amount of the underallocation c. decrease cogs for the amount of the underallocation d. increase cogs for the amount of the underallocation

Answers: 3

Business, 22.06.2019 19:00

Which of the following would cause a shift to the right of the supply curve for gasoline? i. a large increase in the price of public transportation. ii. a large decrease in the price of automobiles. iii. a large reduction in the costs of producing gasoline

Answers: 1

Business, 22.06.2019 20:20

John has served as the chief operating officer (coo) for business graphics, inc., a publicly owned firm, the past 5 years. which of the following statements about john is correct? both john and the ceo of business graphics must certify to the sec that the firm's financial statements are accurate. as the coo, john will be ranked higher than the ceo but still below the cfo. in john's postition as the coo, it is highly unlikely that he would also be the chairperson of the board of directors. as the coo, john would typically be involved with accounting, finance, and asset purchase decisions.

Answers: 2

You know the right answer?

G Gustavo is considering an investment proposal that requires an initial investment of $91,100, has...

Questions

Mathematics, 16.04.2020 00:12

Mathematics, 16.04.2020 00:12

Mathematics, 16.04.2020 00:12

Mathematics, 16.04.2020 00:12

Mathematics, 16.04.2020 00:12

Biology, 16.04.2020 00:12

Biology, 16.04.2020 00:12

English, 16.04.2020 00:12

History, 16.04.2020 00:12

Mathematics, 16.04.2020 00:12

Biology, 16.04.2020 00:12