Business, 06.05.2020 06:20 janayshas84

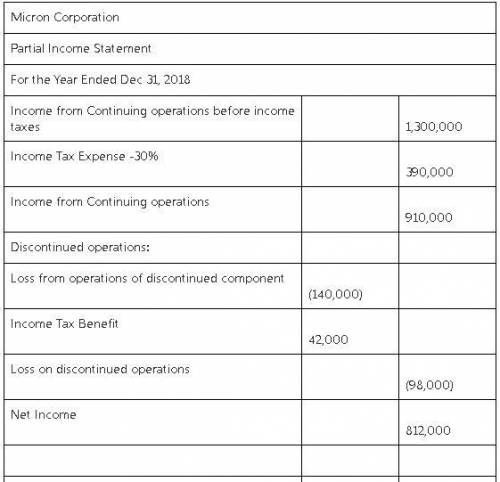

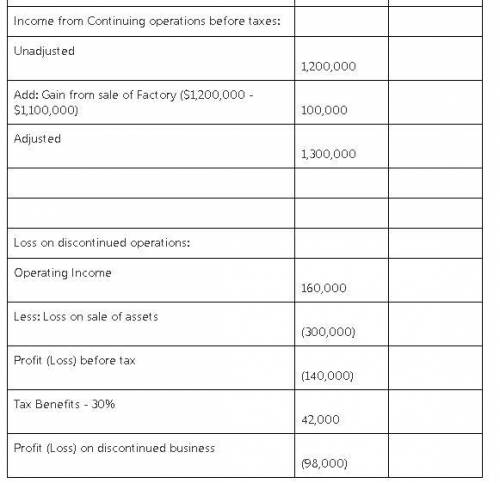

For the year ending December 31, 2018, Micron Corporation had income from continuing operations before taxes of $1,200,000 before considering the following transactions and events. All of the items described below are before taxes and the amounts should be considered material.1. In November 2018, Micron sold its Waffle House restaurant chain that qualified as a component of an entity. The company had adopted a plan to sell the chain in May 2018. The income from operations of the chain from January 1, 2018, through November was $160,000 and the loss on sale of the chain’s assets was $300,000.In 2018, Micron sold one of its six factories for $1,200,000. At the time of the sale, the factory had a book value of $1,100,000. The factory was not considered a component of the entity.2. In 2016, Micron’s accountant omitted the annual adjustment for patent amortization expense of $120,000. The error was not discovered until December 2018.Required:.Prepare Micron’s income statement, beginning with income from continuing operations before taxes, for the year ended December 31, 2018. Assume an income tax rate of 30%. Ignore EPS disclosures. (Amounts to be deducted should be indicated with a minus sign. MICRON CORPORATION Partial Income Statement For the Year Ended December 31, 2018Income from continuing operations before income taxes Income tax benefit Income from continuing operations Discontinued operations: Loss from operations of discontinued component Income tax benefit Loss on discontinued operations

Answers: 1

Another question on Business

Business, 22.06.2019 20:00

Double corporation acquired all of the common stock of simple company for

Answers: 1

Business, 23.06.2019 00:40

Assume the total cost of a college education will be $250,000 when your child enters college in 17 years. you presently have $69,000 to invest. what annual rate of interest must you earn on your investment to cover the cost of your child’s college education? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

Answers: 2

Business, 23.06.2019 03:00

Depasquale corporation is working on its direct labor budget for the next two months. each unit of output requires 0.61 direct labor-hours. the direct labor rate is $8.70 per direct labor-hour. the production budget calls for producing 6,700 units in may and 7,100 units in june. if the direct labor work force is fully adjusted to the total direct labor-hours needed each month, what would be the total combined direct labor cost for the two months?

Answers: 3

Business, 23.06.2019 12:30

30 points + mark as the brainliest use the internet to research legal concerns that could result from increased use of technology in business. discuss some of these concerns.

Answers: 3

You know the right answer?

For the year ending December 31, 2018, Micron Corporation had income from continuing operations befo...

Questions

Mathematics, 04.09.2021 14:40

Mathematics, 04.09.2021 14:40

Biology, 04.09.2021 14:40

Spanish, 04.09.2021 14:40

Mathematics, 04.09.2021 14:40

Mathematics, 04.09.2021 14:40

Chemistry, 04.09.2021 14:40

Mathematics, 04.09.2021 14:50

World Languages, 04.09.2021 14:50

Business, 04.09.2021 14:50

Computers and Technology, 04.09.2021 14:50

Mathematics, 04.09.2021 14:50

Mathematics, 04.09.2021 14:50