Business, 06.05.2020 06:22 Josephcastillo5246

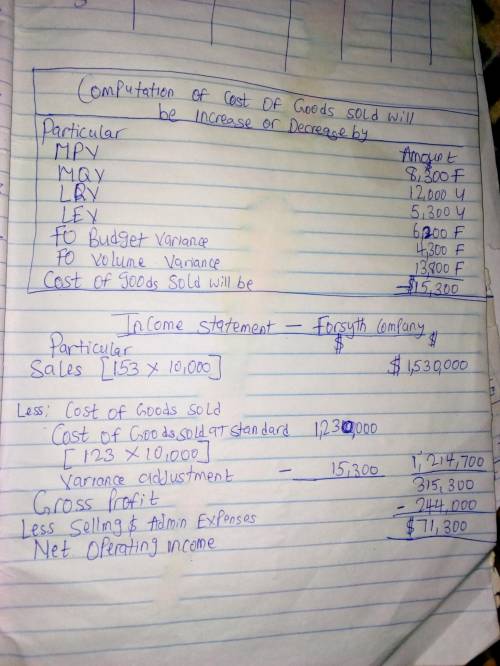

Forsyth Company manufactures one product, it does not maintain any beginning or ending inventories, and its uses a standard cost system. During the year, the company produced and sold 10,000 units at a price of $153 per unit. Its standard cost per unit produced is $123 and its selling and administrative expenses totaled $244,000. Forsyth does not have any variable manufacturing overhead costs and it recorded the following variances during the year: Materials price variance$8,300FMaterials quantity variance$12,000ULabor rate variance$5,300ULabor efficiency variance$6,200FFixed overhead budget variance$4,300FFixed overhead volume variance$13,800F Required:1. When Forsyth closes its standard cost variances, the cost of goods sold will increase (decrease) by how much. 2. Prepare an income statement for the year.

Answers: 3

Another question on Business

Business, 22.06.2019 07:30

When selecting a savings account, you should look at the following factors except annual percentage yield (apy) fees minimum balance interest thresholds taxes paid on the interest variable interest rates

Answers: 1

Business, 22.06.2019 17:30

What is the sequence of events that could lead to trade surplus

Answers: 3

Business, 22.06.2019 19:00

For each of the following cases determine the ending balance in the inventory account. (hint: first, determine the total cost of inventory available for sale. next, subtract the cost of the inventory sold to arrive at the ending balance.)a. jill’s dress shop had a beginning balance in its inventory account of $40,000. during the accounting period jill’s purchased $75,000 of inventory, returned $5,000 of inventory, and obtained $750 of purchases discounts. jill’s incurred $1,000 of transportation-in cost and $600 of transportation-out cost. salaries of sales personnel amounted to $31,000. administrative expenses amounted to $35,600. cost of goods sold amounted to $82,300.b. ken’s bait shop had a beginning balance in its inventory account of $8,000. during the accounting period ken’s purchased $36,900 of inventory, obtained $1,200 of purchases allowances, and received $360 of purchases discounts. sales discounts amounted to $640. ken’s incurred $900 of transportation-in cost and $260 of transportation-out cost. selling and administrative cost amounted to $12,300. cost of goods sold amounted to $33,900.a& b. cost of goods avaliable for sale? ending inventory?

Answers: 1

You know the right answer?

Forsyth Company manufactures one product, it does not maintain any beginning or ending inventories,...

Questions

Biology, 10.12.2019 11:31

Mathematics, 10.12.2019 11:31

Mathematics, 10.12.2019 11:31

Mathematics, 10.12.2019 11:31

Mathematics, 10.12.2019 11:31

Physics, 10.12.2019 11:31

World Languages, 10.12.2019 11:31

Social Studies, 10.12.2019 11:31

History, 10.12.2019 11:31