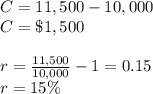

Donna purchased stock valued at $10,000 in 2000. In 2005, she sold the stock for 11,500.

...

Donna purchased stock valued at $10,000 in 2000. In 2005, she sold the stock for 11,500.

Donna's capital gain, for tax purposes is $, which is a % gain on her investment.

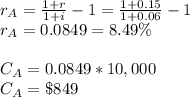

Over the period during which Donna owned her stock, asset prices rose by 6% due to inflation. Thus, Donna's real capital gain is %, or $.

Answers: 2

Another question on Business

Business, 23.06.2019 21:00

Acompany recently announced that it would be going public. the usual suspects, morgan stanley, jpmorgan chase, and goldman sachs will be the lead underwriters. the value of the company has been estimated to range from a low of $5billion to a high of $100billion, with $45billion being the most likely value. if there is a 20% chance that the price will be at the low end, a 10% chance that the price will be at the high end, and a 70% chance that the price will be in the middle, what value should the owner expect the company to price at?

Answers: 3

Business, 24.06.2019 00:00

Multiple choice question 55 margin of safety in dollars is expected sales less break-even sales. actual sales less expected sales. expected sales divided by break-even sales. expected sales less actual sales.

Answers: 2

Business, 24.06.2019 03:30

Review the audit documentation prepared by green and brown, llp, related to trs's notes payable and list deficiencies on the enclosed schedules.

Answers: 2

Business, 24.06.2019 06:00

Encryption is a necessary part of which information security approach ais ch 9

Answers: 2

You know the right answer?

Questions

History, 04.01.2020 07:31

History, 04.01.2020 07:31

Mathematics, 04.01.2020 07:31

Advanced Placement (AP), 04.01.2020 07:31

Mathematics, 04.01.2020 07:31

History, 04.01.2020 07:31

Mathematics, 04.01.2020 07:31

Mathematics, 04.01.2020 07:31