Financial data for Joel de Paris, Inc., for last year follow: Joel de Paris, Inc. Balance Sheet Beginning Balance Ending Balance Assets Cash $ 132,000 $ 137,000 Accounts receivable 330,000 483,000 Inventory 573,000 476,000 Plant and equipment, net 845,000 824,000 Investment in Buisson, S. A. 397,000 431,000 Land (undeveloped) 248,000 251,000 Total assets $ 2,525,000 $ 2,602,000 Liabilities and Stockholders' Equity Accounts payable $ 385,000 $ 341,000 Long-term debt 1,014,000 1,014,000 Stockholders' equity 1,126,000 1,247,000 Total liabilities and stockholders' equity $ 2,525,000 $ 2,602,000 Joel de Paris, Inc. Income Statement Sales $ 4,180,000 Operating expenses 3,553,000 Net operating income 627,000 Interest and taxes: Interest expense $ 116,000 Tax expense 201,000 317,000 Net income $ 310,000 The company paid dividends of $189,000 last year. The "Investment in Buisson, S. A.," on the balance sheet represents an investment in the stock of another company. The company's minimum required rate of return of 15%.

Required:

1. Compute the company's average operating assets for last year.

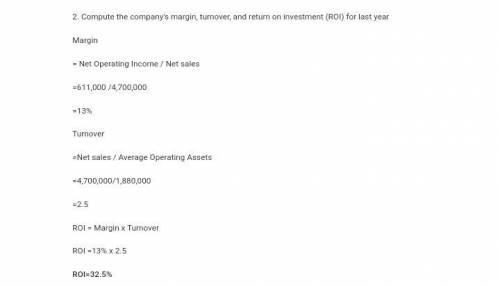

2. Compute the company’s margin, turnover, and return on investment (ROI) for last year. (Round "Margin", "Turnover" and "ROI" to 2 decimal places.)

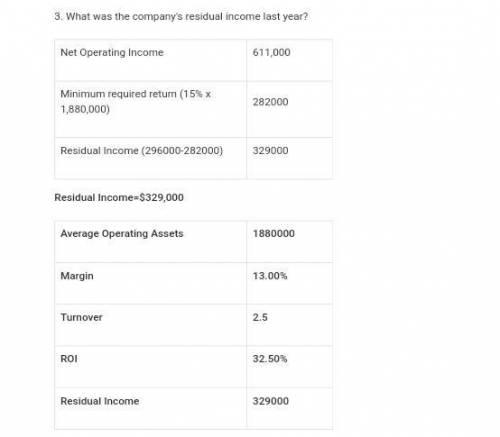

3. What was the company’s residual income last year?

Answers: 1

Another question on Business

Business, 21.06.2019 21:50

Franklin painting company is considering whether to purchase a new spray paint machine that costs $4,800. the machine is expected to save labor, increasing net income by $720 per year. the effective life of the machine is 15 years according to the manufacturer’s estimate. required determine the unadjusted rate of return based on the average cost of the investment.

Answers: 2

Business, 22.06.2019 12:40

When cell phones were first entering the market, they were relatively large and reception was undependable. all cell phones were essentially the same. but as the technology developed, many competitors entered, introducing features unique to their phones. today, cell phones are only a small fraction of the size and weight of their predecessors. consumers can buy cell phones with color screens, cameras, internet access, daily planners, or voice activation (and any combination of these features). the history of the cell phone demonstrates what marketing trend?

Answers: 3

Business, 22.06.2019 22:10

jackie's snacks sells fudge, caramels, and popcorn. it sold 12,000 units last year. popcorn outsold fudge by a margin of 2 to 1. sales of caramels were the same as sales of popcorn. fixed costs for jackie's snacks are $14,000. additional information follows: product unit sales prices unit variable cost fudge $5.00 $4.00 caramels $8.00 $5.00 popcorn $6.00 $4.50 the breakeven sales volume in units for jackie's snacks is

Answers: 1

Business, 22.06.2019 22:20

With q7 assume the sweet company uses a plantwide predetermined overhead rate with machine-hours as the allocation base.and for q 10,11,13,and 14,assume that the company use department predetermined overhead rates with machine-hours as the allocation bade in both departements.7. assume that sweeten company used cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. what selling price would the company have established for jobs p and q? what are the selling prices for both jobs when stated on a per unit basis assuming 20 units were produced for job p and 30 units were produced for job q? (do not round intermediate calculations. round your final answers to nearest whole dollar.)total price for the job for job p -job q selling price per unit for job p q . how much manufacturing overhead was applied from the molding department to job p and how much was applied to job q? (do not round intermediate calculations.) job p job q manufacturing overhead applied for job p for job q . how much manufacturing overhead was applied from the fabrication department to job p and how much was applied to job q? (do not round intermediate calculations.)job p job q manufacturing overhead applied for job p for job q . if job q included 30 units, what was its unit product cost? (do not round intermediate calculations. round your final answer to nearest whole dollar.)14. assume that sweeten company used cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. what selling price would the company have established for jobs p and q? what are the selling prices for both jobs when stated on a per unit basis assuming 20 units were produced for job p and 30 units were produced for job q? (do not round intermediate calculations. round your final answer to nearest whole dollar.)total price for the job p for job q selling price per unit for job p for job q

Answers: 1

You know the right answer?

Financial data for Joel de Paris, Inc., for last year follow: Joel de Paris, Inc. Balance Sheet Begi...

Questions

Mathematics, 23.10.2020 01:01

Social Studies, 23.10.2020 01:01

Mathematics, 23.10.2020 01:01

Social Studies, 23.10.2020 01:01

Mathematics, 23.10.2020 01:01

Mathematics, 23.10.2020 01:01

Mathematics, 23.10.2020 01:01

Social Studies, 23.10.2020 01:01

Health, 23.10.2020 01:01

Geography, 23.10.2020 01:01

Computers and Technology, 23.10.2020 01:01

Health, 23.10.2020 01:01