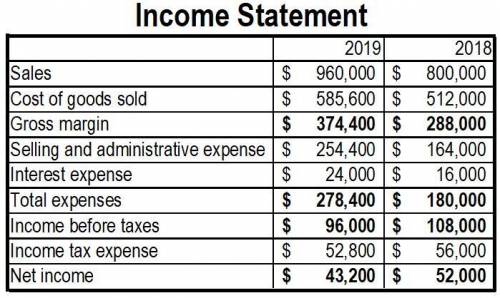

He following percentages apply to Thornton Company for 2018 and 2019: 2019 2018 Sales 100.0 % 100.0 % Cost of goods sold 61.0 64.0 Gross margin 39.0 36.0 Selling and administrative expense 26.5 20.5 Interest expense 2.5 2.0 Total expenses 29.0 22.5 Income before taxes 10.0 13.5 Income tax expense 5.5 7.0 Net income 4.5 % 6.5 % Required Assuming that sales were $800,000 in 2018 and $960,000 in 2019, prepare income statements for the two years.

Answers: 1

Another question on Business

Business, 22.06.2019 05:00

Xie company identified the following activities, costs, and activity drivers for 2017. the company manufactures two types of go-karts: deluxe and basic. activity expected costs expected activity handling materials $ 625,000 100,000 parts inspecting product 900,000 1,500 batches processing purchase orders 105,000 700 orders paying suppliers 175,000 500 invoices insuring the factory 300,000 40,000 square feet designing packaging 75,000 2 models required: 1. compute a single plantwide overhead rate, assuming that the company assigns overhead based on 125,000 budgeted direct labor hours. 2. in january 2017, the deluxe model required 2,500 direct labor hours and the basic model required 6,000 direct labor hours. assign overhead costs to each model using the single plantwide overhead rate.

Answers: 3

Business, 22.06.2019 05:50

Match the steps for conducting an informational interview with the tasks in each step.

Answers: 1

Business, 22.06.2019 19:00

Tri fecta, a partnership, had revenues of $369,000 in its first year of operations. the partnership has not collected on $45,000 of its sales and still owes $39,500 on $155,000 of merchandise it purchased. there was no inventory on hand at the end of the year. the partnership paid $27,000 in salaries. the partners invested $48,000 in the business and $23,000 was borrowed on a five-year note. the partnership paid $2,070 in interest that was the amount owed for the year and paid $9,500 for a two-year insurance policy on the first day of business. compute net income for the first year for tri fecta.

Answers: 2

Business, 22.06.2019 19:40

Which term describes an alternative to car buying where monthly payments are paid for a specific period of time, after which the vehicle is returned to the dealership or bought? a. car financing b. car maintenance c. car leasing d. car ownership

Answers: 3

You know the right answer?

He following percentages apply to Thornton Company for 2018 and 2019: 2019 2018 Sales 100.0 % 100.0...

Questions

Physics, 09.10.2021 01:00

Mathematics, 09.10.2021 01:00

Physics, 09.10.2021 01:00

History, 09.10.2021 01:00

Computers and Technology, 09.10.2021 01:00

Mathematics, 09.10.2021 01:00

Spanish, 09.10.2021 01:00

Biology, 09.10.2021 01:00

Physics, 09.10.2021 01:00

Mathematics, 09.10.2021 01:00