Business, 05.05.2020 22:05 washingtonisaia

Good Time Company is a regional chain department store. It will remain in business for one more year. The probability of a boom year is 80 percent and the probability of a recession is 20 percent. It is projected that the company will generate a total cash flow of $204 million in a boom year and $95 million in a recession. The company's required debt payment at the end of the year is $129 million. The market value of the company’s outstanding debt is $102 million. The company pays no taxes.

a. What payoff do bondholders expect to receive in the event of a recession?

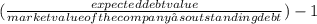

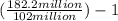

b. What is the promised return on the company's debt?

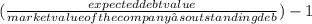

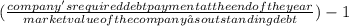

c. What is the expected return on the company's debt?

Answers: 2

Another question on Business

Business, 22.06.2019 00:00

Which of the following is a disadvantage to choosing a sole proprietorship business structure? question 9 options: the owner has personal responsibility for the company's liabilities. the owner has to share the profits with partners. the owner is still liable for personal debts. the owner has to report to shareholders.

Answers: 1

Business, 22.06.2019 07:00

What is the state tax rate for a resident of arizona whose annual taxable income is $18,000?

Answers: 1

Business, 22.06.2019 08:00

How do communism and socialism differ in terms of the role that government plays in the economy ?

Answers: 1

Business, 22.06.2019 16:00

In microeconomics, the point at which supply and demand meet is called the blank price

Answers: 3

You know the right answer?

Good Time Company is a regional chain department store. It will remain in business for one more year...

Questions

Social Studies, 15.11.2019 21:31

Computers and Technology, 15.11.2019 21:31

History, 15.11.2019 21:31

English, 15.11.2019 21:31

Mathematics, 15.11.2019 21:31

Mathematics, 15.11.2019 21:31

t ($102 million).

t ($102 million).

expected debt value = (80% ×$204 million ) + ( 20% × $95 million)

expected debt value = (80% ×$204 million ) + ( 20% × $95 million)