Business, 05.05.2020 22:16 latinotimo4890

Background and an Invitation to the "Piranha Pen"

Imagine that you have developed a new dog leash and harness called "2Chainz". The product features a unique double helix, chain-like structure made out of nylon that helps prevent dogs from pulling their owner during walks. You also recently received an invitation to present "2Chainz" on an episode of a television show called "Piranha Pen". The show gives entrepreneurs the opportunity to pitch their products to a panel of wealthy businesspeople (aka "Piranhas") in the hopes of landing an investment deal. The Piranhas are known to be savvy negotiators and are famous for asking tough questions and having high standards before making an investment. Therefore, it is critical that you be well-prepared.

In preparation for the show, you pull together the following data from a variety of sources.

Market Research Data

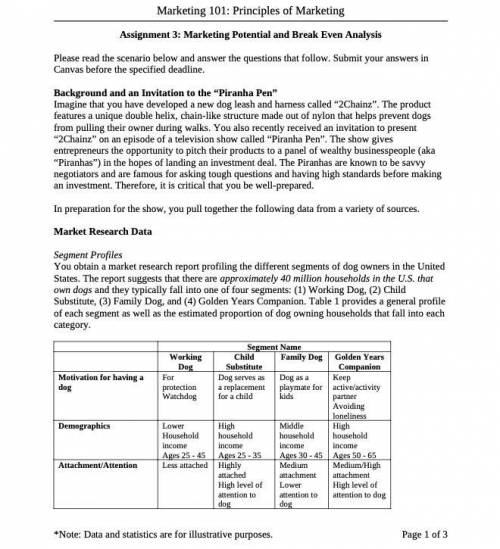

Segment Profiles

You obtain a market research report profiling the different segments of dog owners in the United States. The report suggests that there are approximately 40 million households in the U. S. that own dogs and they typically fall into one of four segments: (1) Working Dog, (2) Child Substitute, (3) Family Dog, and (4) Golden Years Companion. Table 1 provides a general profile of each segment as well as the estimated proportion of dog owning households that fall into each category.

Segment Name

Working Dog Child Substitute Family Dog Golden Years Companion

Motivation for having a dog For protection

Watchdog Dog serves as a replacement for a child Dog as a playmate for kids Keep active/activity partner

Avoiding loneliness

Demographics Lower income

Ages 25 to 45 High income

Ages 25 - 35 Middle income

Ages 30 - 45 High income

Ages 50 - 65

Attachment/Attention Less attached Highly attached

High level of attention to dog Medium attachment

Lower attention to dog Medium/High attachment

High level of attention to dog

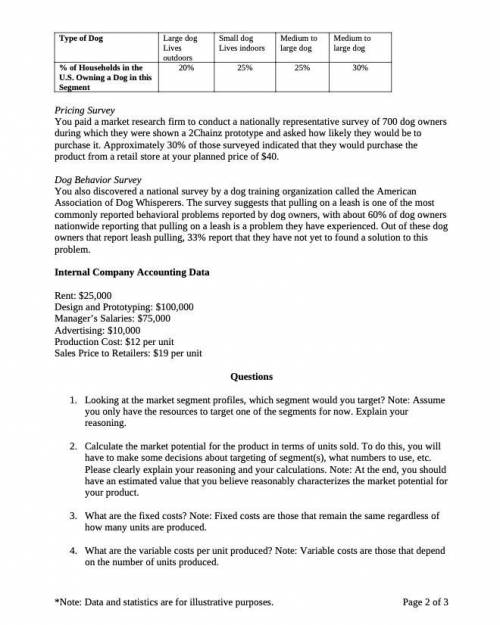

Type of Dog Large dog

Lives outdoors Small dog

Dog lives indoors Medium to large dog Medium to large dog

% of Households in the U. S. Owning a Dog in this Segment 20% 25% 25% 30%

Pricing Survey

You paid a market research firm to conduct a nationally representative survey of 700 dog owners during which they were shown a 2Chainz prototype and asked how likely they would be to purchase it. Approximately 30% of those surveyed indicated that they would purchase the product from a retail store at your planned price of $40.

Dog Behavior Survey

You also discovered a national survey by a dog training organization called the American Association of Dog Whisperers. The survey suggests that pulling on a leash is one of the most commonly reported behavioral problems reported by dog owners, with about 60% of dog owners nationwide reporting that pulling on a leash is a problem they have experienced. Out of these dog owners that report leash pulling, 33% report that they have not yet to found a solution to this problem.

Internal Company Accounting Data

Rent: $25,000

Design and Prototyping: $100,000

Manager’s Salaries: $75,000

Advertising: $10,000

Production Cost: $12 per unit

Sales Price to Retailers: $19 per unit

Questions

Looking at the market segment profiles, which segment would you target? Note: Assume you only have the resources to target one of the segments for now. Explain your reasoning.

Calculate the market potential for the product in terms of units sold. To do this, you will have to make some decisions about targeting of segment(s), what numbers to use, etc. Please clearly explain your reasoning and your calculations. Note: At the end, you should have an estimated value that you believe reasonably characterizes the market potential for your product.

What are the fixed costs? Note: Fixed costs are those that remain the same regardless of how many units are produced.

What are the variable costs per unit produced? Note: Variable costs are those that depend on the number of units produced.

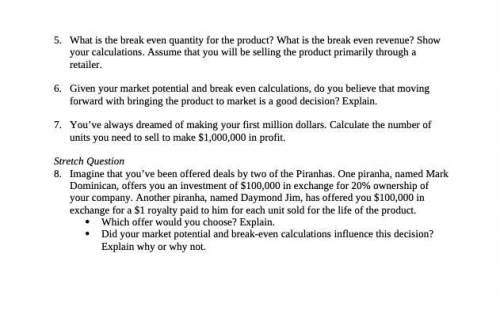

What is the break even quantity for the product? What is the break even revenue? Show your calculations. Assume that you will be selling the product primarily through a retailer.

Given your market potential and break even calculations, do you believe that moving forward with bringing the product to market is a good decision? Explain.

You’ve always dreamed of making your first million dollars. Calculate the number of units you need to sell to make $1,000,000 in profit.

Imagine that you’ve been offered deals by two of the Piranhas. One piranha, named Mark Dominican, offers you an investment of $100,000 in exchange for 20% ownership of your company. Another piranha, named Daymond Jim, has offered you $100,000 in exchange for a $1 royalty paid to him for each unit sold for the life of the product.

Which offer would you choose? Explain.

Did your market potential and break even calculations influence this decision? Explain why or why not.

Answers: 3

Another question on Business

Business, 22.06.2019 03:00

Afirm's before-tax cost of debt, rd, is the interest rate that the firm must pay on debt. because interest is tax deductible, the relevant cost of debt used to calculate a firm's wacc is the cost of debt, rd (1 – t). the cost of debt is used in calculating the wacc because we are interested in maximizing the value of the firm's stock, and the stock price depends on cash flows. it is important to emphasize that the cost of debt is the interest rate on debt, not debt because our primary concern with the cost of capital is its use in capital budgeting decisions. the rate at which the firm has borrowed in the past is because we need to know the cost of capital. for these reasons, the on outstanding debt (which reflects current market conditions) is a better measure of the cost of debt than the . the on the company's -term debt is generally used to calculate the cost of debt because more often than not, the capital is being raised to fund -term projects. quantitative problem: 5 years ago, barton industries issued 25-year noncallable, semiannual bonds with a $1,600 face value and a 8% coupon, semiannual payment ($64 payment every 6 months). the bonds currently sell for $845.87. if the firm's marginal tax rate is 40%, what is the firm's after-tax cost of debt? round your answer to 2 decimal places. do not round intermediate calcu

Answers: 3

Business, 22.06.2019 05:00

Which of the following are considered needs? check all that apply

Answers: 1

Business, 22.06.2019 11:30

10. lucy is catering an important luncheon and wants to make sure her bisque has the perfect consistency. for her bisque to turn out right, it should have the consistency of a. cold heavy cream. b. warm milk. c. foie gras. d. thick oatmeal. student d incorrect

Answers: 2

Business, 22.06.2019 11:50

The smelting department of kiner company has the following production and cost data for november. production: beginning work in process 3,700 units that are 100% complete as to materials and 23% complete as to conversion costs; units transferred out 10,500 units; and ending work in process 8,100 units that are 100% complete as to materials and 41% complete as to conversion costs. compute the equivalent units of production for (a) materials and (b) conversion costs for the month of november. materials conversion costs total equivalent units

Answers: 1

You know the right answer?

Background and an Invitation to the "Piranha Pen"

Imagine that you have developed a new dog le...

Imagine that you have developed a new dog le...

Questions

World Languages, 20.07.2019 23:10

Geography, 20.07.2019 23:10

Social Studies, 20.07.2019 23:10

Mathematics, 20.07.2019 23:10

Social Studies, 20.07.2019 23:10

Health, 20.07.2019 23:10

History, 20.07.2019 23:10

History, 20.07.2019 23:10

Mathematics, 20.07.2019 23:10