Business, 05.05.2020 19:02 morganpl415

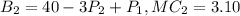

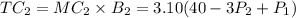

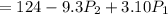

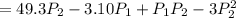

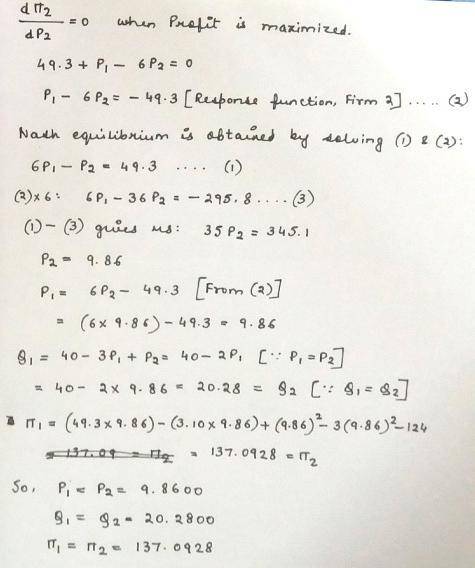

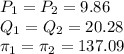

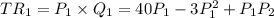

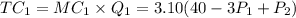

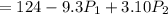

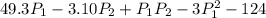

Two firms produce and sell differentiated products that are substitutes for each other. Their demand curves are Firm 1: Upper Q 1Q1 = 40minus−3Upper P 1P1+ Upper P 2P2 Firm 2: Upper Q 2Q2 = 40minus−3Upper P 2P2+ Upper P 1P1 Both firms have constant marginal costs of $4.604.60 per unit. Both firms set their own price and take their competitor's price as fixed. Use the Nash equilibrium concept to determine the equilibrium set of prices. Since the firms are identical, they will set the same prices and produce the same quantities. In equilibrium, each firm will charge a price of $nothing and produce nothing units of output. (Enter your responses rounded to two decimal places.) Each firm will earn a profit of $nothing. (Enter your response rounded to two decimal places.)

Answers: 2

Another question on Business

Business, 21.06.2019 19:20

Which of the following accurately describes a surplus? a. consumer demand for a certain car is below the number of cars that are produced. b. the production costs for a certain car are below the sale price of that car. c. a reduction in the cost of steel enables a car company to reduce the sale price of its cars. d. a car company tries to charge too high a price for a car and has to reduce the price. 2b2t

Answers: 1

Business, 21.06.2019 21:50

Discuss how the resource-based view (rbv) of the firm combines the two perspectives of (1) an internal analysis of a firm and (2) an external analysis of its industry and its competitive environment. include comments on the different types of firm resources and how these resources can be used by a firm to build sustainable competitive advantages.

Answers: 3

Business, 22.06.2019 20:00

If a government accumulates chronic budget deficits over time, what's one possible result? a. a collective action problem b. a debt crisis c. regulatory capture d. an unfunded liability

Answers: 2

Business, 22.06.2019 20:20

Xinhong company is considering replacing one of its manufacturing machines. the machine has a book value of $39,000 and a remaining useful life of 5 years, at which time its salvage value will be zero. it has a current market value of $49,000. variable manufacturing costs are $33,300 per year for this machine. information on two alternative replacement machines follows. alternative a alternative b cost $ 115,000 $ 117,000 variable manufacturing costs per year 22,900 10,100 1. calculate the total change in net income if alternative a and b is adopted. 2. should xinhong keep or replace its manufacturing machine

Answers: 1

You know the right answer?

Two firms produce and sell differentiated products that are substitutes for each other. Their demand...

Questions

Mathematics, 29.04.2021 23:50

Mathematics, 29.04.2021 23:50

Mathematics, 29.04.2021 23:50

Physics, 29.04.2021 23:50

History, 29.04.2021 23:50

English, 29.04.2021 23:50

Social Studies, 29.04.2021 23:50

Mathematics, 29.04.2021 23:50

Mathematics, 29.04.2021 23:50

Mathematics, 29.04.2021 23:50

Mathematics, 29.04.2021 23:50

Mathematics, 29.04.2021 23:50

Arts, 29.04.2021 23:50

when profit is maximized

when profit is maximized

[Response Function for firm 1] ...........(1)

[Response Function for firm 1] ...........(1)