Headland Company sponsors a defined benefit pension plan for its employees. The following data relate to the operation of the plan for the years 2020 and 2021.

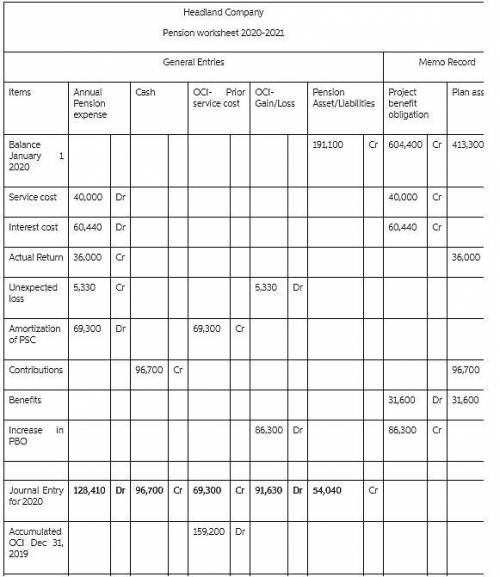

2020

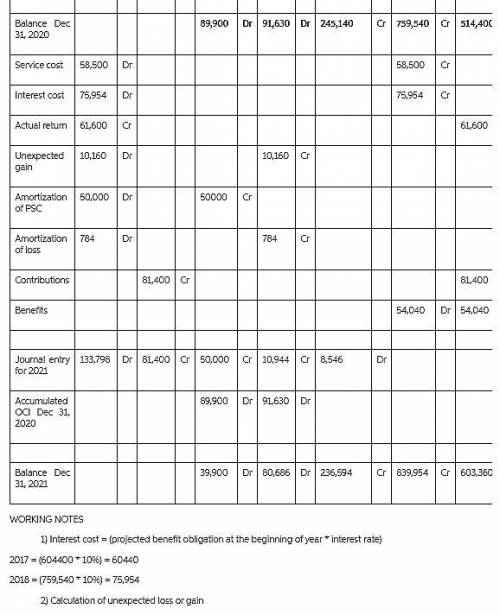

2021

Projected benefit obligation, January 1 $604,400

Plan assets (fair value and market-related value), January 1 413,300

Pension asset/liability, January 1 191,100 Cr.

Prior service cost, January 1 159,200

Service cost 40,000 $58,500

Settlement rate 10 % 10 %

Expected rate of return 10 % 10 %

Actual return on plan assets 36,000 61,600

Amortization of prior service cost 69,300 50,000

Annual contributions 96,700 81,400

Benefits paid retirees 31,600 54,040

Increase in projected benefit obligation due to changes in actuarial assumptions 86,300 0

Accumulated benefit obligation at December 31 722,000 792,600

Average service life of all employees 20 years

Vested benefit obligation at December 31

465,900

1.Prepare a pension worksheet presenting both years 2020 and 2021.

2.

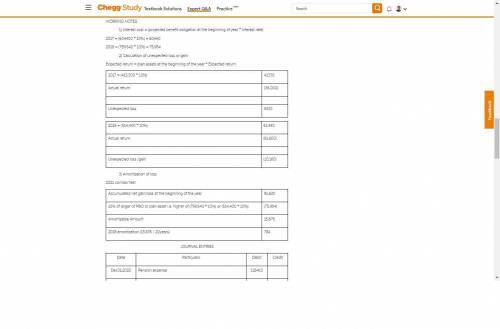

Prepare the journal entries (from the worksheet) to reflect all pension plan transactions and events at December 31 of each year.

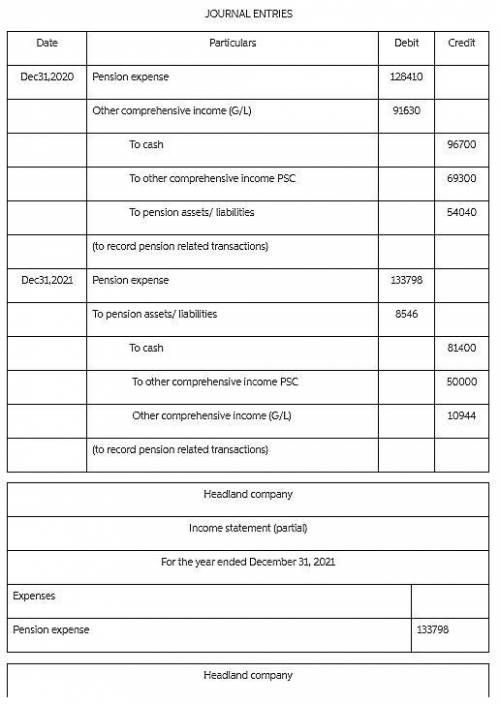

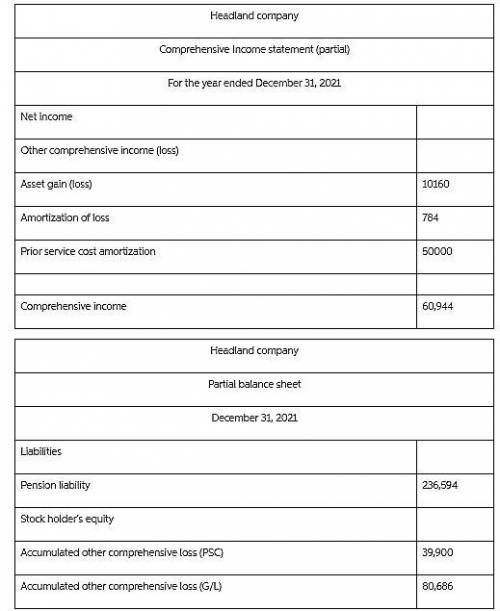

3. For 2021, indicate the pension amounts reported in the financial statements.

Answers: 1

Another question on Business

Business, 22.06.2019 00:40

The silverside company is considering investing in two alternative projects: project 1 project 2 investment $500,000 $240,000 useful life (years) 8 7 estimated annual net cash inflows for useful life $120,000 $40,000 residual value $32,000 $10,000 depreciation method straightminusline straightminusline required rate of return 11% 8% what is the accounting rate of return for project 2? (round any intermediary calculations to the nearest dollar, and round your final answer to the nearest hundredth of a percent, x.xx%.)

Answers: 3

Business, 22.06.2019 05:00

The new york stock exchange is an example of what type of stock market?

Answers: 1

Business, 22.06.2019 10:40

Two assets have the following expected returns and standard deviations when the risk-free rate is 5%: asset a e(ra) = 18.5% σa = 20% asset b e(rb) = 15% σb = 27% an investor with a risk aversion of a = 3 would find that on a risk-return basis. a. only asset a is acceptable b. only asset b is acceptable c. neither asset a nor asset b is acceptable d. both asset a and asset b are acceptable

Answers: 2

Business, 22.06.2019 20:30

Afirm wants to hire a project manager (pm) at a salary of $100,000. 30% of pms have high ability, and 70% of pms have low ability. high ability pms generate $120,000 in revenue and low ability pms generate $80,000 in revenue. in addition to differences in productivity, high and low ability pms have different outside offers. if a high ability pm is not hired by the firm, she can work for another company at a salary of $80,000. if the low ability pm is not hired by the firm, she can work for another company for $70,000. high ability pms are also able to get a project management professional (pmp) certification at a cost of $1,000. low ability pms are unable to get a pmp certification (they would fail the test). the firm is not able to observe a pm’s ability, but is able to observe and verify whether or not the pm has a pmp certificate.(a) draw the extensive form of the game.expert answer

Answers: 3

You know the right answer?

Headland Company sponsors a defined benefit pension plan for its employees. The following data relat...

Questions

History, 03.03.2020 04:32

Mathematics, 03.03.2020 04:32