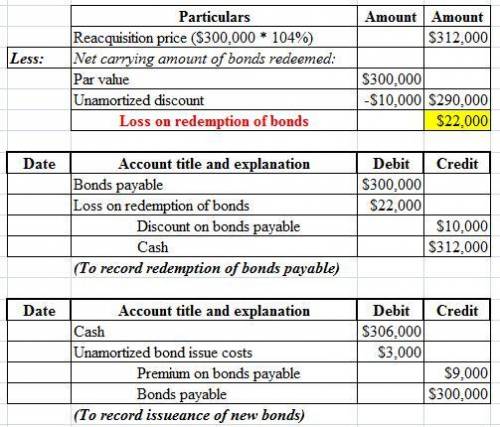

Linda Day George Company had bonds outstanding with a maturity value of $300,000. On April 30, 2014, when these bonds had an unamortized discount of $10,000, they were called in at 104. To pay for these bonds, George had issued other bonds a month earlier bearing a lower interest rate. The newly issued bonds had a life of 10 years. The new bonds were issued at 103 (face value $300,000). Issue costs related to the new bonds were $3,000.Ignoring interest, compute the gain or loss. (Round answer to 0 decimal places, e. g. 38,548.)Loss on redemption $Linda Day George Company had bonds outstanding witIgnoring interest, record this refunding transaction. (Round answers to 0 decimal places, e. g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)Account Titles and Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding wit(To record redemption of bonds payable.)Linda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding wit

Answers: 3

Another question on Business

Business, 22.06.2019 20:20

You are the cfo of a u.s. firm whose wholly owned subsidiary in mexico manufactures component parts for your u.s. assembly operations. the subsidiary has been financed by bank borrowings in the united states. one of your analysts told you that the mexican peso is expected to depreciate by 30 percent against the dollar on the foreign exchange markets over the next year. what actions, if any, should you take

Answers: 2

Business, 23.06.2019 01:10

Hillside issues $4,000,000 of 6%, 15-year bonds dated january 1, 2016, that pay interest semiannually on june 30 and december 31. the bonds are issued at a price of $4,895,980. required: 1. prepare the january 1, 2016, journal entry to record the bonds’ issuance

Answers: 3

Business, 23.06.2019 02:20

The director of the federal trade commission (ftc) bureau of consumer protection warned that the agency would bring enforcement action against small businesses that select one: a. failed to inform the public about network failures in a timely manner b. failed to transmit sensitive data c. did not report security breaches to law enforcement d. lacked adequate policies and procedures to protect consumer data.

Answers: 2

Business, 23.06.2019 08:00

Wyman corporation uses a process costing system. the company manufactured certain goods at a cost of $920 and sold them on credit to percy corporation for $1,315. the complete journal entry to be made by wyman at the time of this sale is:

Answers: 1

You know the right answer?

Linda Day George Company had bonds outstanding with a maturity value of $300,000. On April 30, 2014,...

Questions

Biology, 20.07.2019 22:30

History, 20.07.2019 22:30

History, 20.07.2019 22:30

English, 20.07.2019 22:30

Social Studies, 20.07.2019 22:30

History, 20.07.2019 22:30