Business, 05.05.2020 16:31 marinahuntg

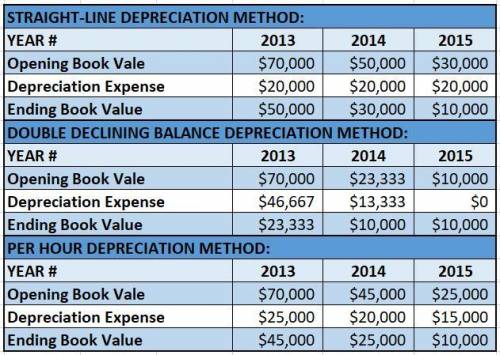

On April 1, 2013, Four Seasons Landscaping, LLC purchased new lawn mowers for $70,000 in cash (total cost). They have a useful life of 3 years and a $10,000 residual value. Over its life, each machine is estimated to run 1,200 engine hours (EH), 500 EH in 2013, 400 EH in 2014 and 300 EH in 2015 (Assume these to be actual hours, as well). As of December 31, compute the amount of depreciation for each of the years indicated under the three different methods of depreciation: Use whole dollars in your answers. Show only the depreciation expense for each year, you do not need to show the accumulated depreciation!

Answers: 3

Another question on Business

Business, 22.06.2019 05:40

According to the philosopher immanuel kant, the right of employees to know the nature of the job they are being hired to do and the obligation of a company not to deceive them in this respect is mainly reflective of the basic right of . privac yb. free consentc. freedom of speechd. freedom of consciencee. first refusal

Answers: 1

Business, 22.06.2019 19:50

Bulldog holdings is a u.s.-based consumer electronics company. it owns smaller firms in japan and taiwan where most of its cell phone technology is developed and manufactured before being released worldwide. which of the following alternatives to integration does this best illustrate? a. venture capitalism b. franchising c. joint venture d. parent-subsidiary relationship

Answers: 2

Business, 22.06.2019 20:20

Xinhong company is considering replacing one of its manufacturing machines. the machine has a book value of $39,000 and a remaining useful life of 5 years, at which time its salvage value will be zero. it has a current market value of $49,000. variable manufacturing costs are $33,300 per year for this machine. information on two alternative replacement machines follows. alternative a alternative b cost $ 115,000 $ 117,000 variable manufacturing costs per year 22,900 10,100 1. calculate the total change in net income if alternative a and b is adopted. 2. should xinhong keep or replace its manufacturing machine

Answers: 1

Business, 22.06.2019 21:00

Dozier company produced and sold 1,000 units during its first month of operations. it reported the following costs and expenses for the month: direct materials $ 69,000 direct labor $ 35,000 variable manufacturing overhead $ 15,000 fixed manufacturing overhead 28,000 total manufacturing overhead $ 43,000 variable selling expense $ 12,000 fixed selling expense 18,000 total selling expense $ 30,000 variable administrative expense $ 4,000 fixed administrative expense 25,000 total administrative expense $ 29,000 required: 1. with respect to cost classifications for preparing financial statements: a. what is the total product cost

Answers: 2

You know the right answer?

On April 1, 2013, Four Seasons Landscaping, LLC purchased new lawn mowers for $70,000 in cash (total...

Questions

Computers and Technology, 21.03.2020 07:06

English, 21.03.2020 07:06

Geography, 21.03.2020 07:06

Mathematics, 21.03.2020 07:06

Mathematics, 21.03.2020 07:07

Mathematics, 21.03.2020 07:08

Computers and Technology, 21.03.2020 07:08