Business, 05.05.2020 06:04 kellyrasmussen8189

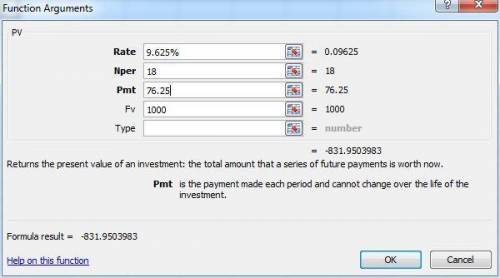

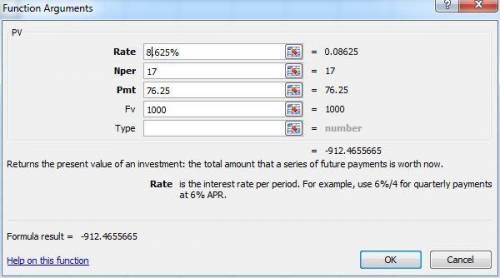

An investor is considering the purchase of a(n) 7.625 %, 18-year corporate bond that's being priced to yield 9.625 %. She thinks that in a year, this bond will be priced in the market to yield 8.625 %. Using annual compounding, find the price of the bond today and in 1 year. Next, find the holding period return on this investment, assuming that the investor's expectations are borne out.

Answers: 3

Another question on Business

Business, 22.06.2019 00:30

Needs to schedule the staffing of the center. it is open from 8am until midnight. larry has monitored the usage of the center at various times of the day and determined that the following number of computer consultants are required: time of dayminimum number of consultants required to be on duty8 am-noon4noon-4 pm84pm-8pm108pm-midnight6 two types of computer consultants can be hired: full-time and part-time. the full- time consultants work for eight consecutive hours in any of the shifts: morning (8am- 4pm), afternoon (noon-8pm) and evening (4pm-midnight). full-time consultants are paid $14 per hour. part-time consultants can be hired to work any of the four shifts listed in the table. part-time consultants are paid $12 per hour. an additional requirement is that during every time period, there must be at least two full-time consultants on duty for every part-time consultant on duty. larry would like to determine how many full-time and part-time consultants should work each shift to meet the above requirements at the minimum possible cost. formulate this as an lp problem. you must define your variables clearly

Answers: 2

Business, 22.06.2019 05:10

The total value of your portfolio is $10,000: $3,000 of it is invested in stock a and the remainder invested in stock b. stock a has a beta of 0.8; stock b has a beta of 1.2. the risk premium on the market portfolio is 8%; the risk-free rate is 2%. additional information on stocks a and b is provided below. return in each state state probability of state stock a stock b excellent 15% 15% 5% normal 50% 9% 7% poor 35% -15% 10% what are each stock’s expected return and the standard deviation? what are the expected return and the standard deviation of your portfolio? what is the beta of your portfolio? using capm, what is the expected return on the portfolio? given your answer above, would you buy, sell, or hold the portfolio?

Answers: 1

Business, 22.06.2019 18:20

Now ray has had the tires for two months and he notices that the tread has started to pull away from the tire. he has already contacted the place who sold the tires and calmly and accurately explained the problem. they didn’t him because they no longer carry that tire. so he talked with the manager and he still did not get the tire replaced. his consumer rights are being violated. pretend you are ray and write a letter to the company’s headquarters. here are some points to keep in mind when writing the letter: include your name, address, and account number, if appropriate. describe your purchase (name of product, serial numbers, date and location of purchase). state the problem and give the history of how you tried to resolve the problem. ask for a specific action. include how you can be reached.

Answers: 3

Business, 22.06.2019 19:30

One of the benefits of a well designed ergonomic work environment is low operating costs is true or false

Answers: 3

You know the right answer?

An investor is considering the purchase of a(n) 7.625 %, 18-year corporate bond that's being priced...

Questions

Biology, 15.07.2019 04:40

Health, 15.07.2019 04:40

History, 15.07.2019 04:40

Biology, 15.07.2019 04:40

Geography, 15.07.2019 04:40

Social Studies, 15.07.2019 04:40

Physics, 15.07.2019 04:40

English, 15.07.2019 04:40