Business, 05.05.2020 04:26 Marcus2935

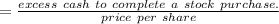

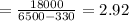

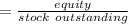

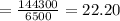

Startup Pipe has a market value equal to its book value. Currently, the company has excess cash of $14,652, other assets of $152,900, and equity valued at $144,300. There are 6,500 shares of stock outstanding and net income is $18,000. What will the new earnings per share be if the firm decides to use 50 percent of its excess cash to complete a stock repurchase

Answers: 3

Another question on Business

Business, 21.06.2019 15:30

Walter wants to deposit $1,500 into a certificate of deposit at the end of each ofthe next 6 years. the deposits will earn 5 percent compound annual interest. ifwalter follows through with his plan, approximately how much will be in his accountimmediately after the sixth deposit is made?

Answers: 1

Business, 21.06.2019 23:00

The company financial officer was interested in the average cost of pcs that had been purchased in the past six months. she took a random sample of the price of 10 computers, with the following results. $3,250, $1,127, $2,995, $3,250, $3,445, $3,449, $1,482, $6,120, $3,009, $4,000 what is the iqr?

Answers: 2

Business, 22.06.2019 10:40

Parks corporation is considering an investment proposal in which a working capital investment of $10,000 would be required. the investment would provide cash inflows of $2,000 per year for six years. the working capital would be released for use elsewhere when the project is completed. if the company's discount rate is 10%, the investment's net present value is closest to (ignore income taxes) ?

Answers: 1

Business, 22.06.2019 15:00

(a) what do you think will happen if the price of non-gm crops continues to rise? why? (b) what will happen if the price of non-gm food drops? why?

Answers: 2

You know the right answer?

Startup Pipe has a market value equal to its book value. Currently, the company has excess cash of $...

Questions

Biology, 20.09.2020 05:01

Mathematics, 20.09.2020 05:01

Mathematics, 20.09.2020 05:01

Health, 20.09.2020 05:01

Mathematics, 20.09.2020 05:01

Chemistry, 20.09.2020 05:01

Mathematics, 20.09.2020 05:01

English, 20.09.2020 05:01

Mathematics, 20.09.2020 05:01

$

$