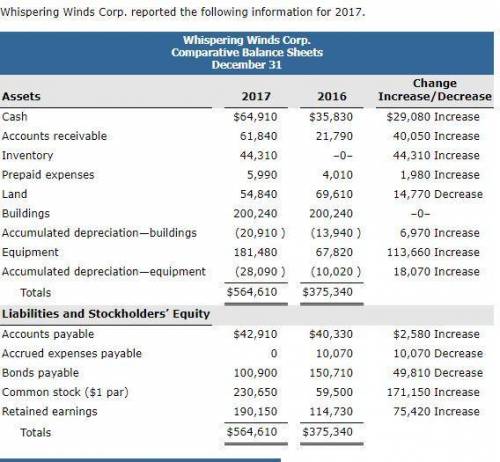

Whispering Winds Corp. Income Statement For the Year Ended December 31, 2017 Sales revenue Cost of goods sold Operating expenses Interest expense Loss on disposal of equipment Income before income taxes Income tax expense Net income $941,820 $472,100 229,800 11,970 2,020 715,890 225,930 64,830 $161,100 Additional information: 1. Operating expenses include depreciation expense of $40,160 2. Land was sold at its book value for cash. 3. Cash dividends of $85,680 were declared and paid in 2017 4. Equipment with a cost of $164,450 was purchased for cash. Equipment with a cost of $50,790 and a book value of $35,670 was sold for $33,650 cash. 5. Bonds of $49,810 were redeemed at their face value for cash. 6. Common stock ($1 par) of $171,150 was issued for cash.

Answers: 2

Another question on Business

Business, 21.06.2019 17:20

Your aunt is thinking about opening a hardware store. she estimates that it would cost $300,000 per year to rent the location and buy the stock. in addition, she would have to quit her $45,000 per year job as an accountant. a. define opportunity cost. b. what is your aunt's opportunity cost of running a hardware store for a year? if your aunt thought she could sell $350,000 worth of merchandise in a year, should she open the store? explain.

Answers: 2

Business, 22.06.2019 14:00

The following costs were incurred in may: direct materials $ 44,800 direct labor $ 29,000 manufacturing overhead $ 29,300 selling expenses $ 26,800 administrative expenses $ 37,100 conversion costs during the month totaled:

Answers: 2

Business, 22.06.2019 15:00

Beagle autos is known for its affordable and reliable brand of consumer vehicles. because its shareholders expect to see an improved rate of growth in the coming years, beagle's executives have decided to diversify the company's range of products so that at least 40 percent of the firm's revenue is generated by new business units. however, the company's resources, capabilities, and competencies are limited to producing other forms of motorized vehicles, such as motorcycles and all-terrain vehicles (atvs). which type of corporate diversification strategy should beagle pursue?

Answers: 1

Business, 22.06.2019 19:30

At december 31, 2016, pina corporation had the following stock outstanding. 10% cumulative preferred stock, $100 par, 107,810 shares $10,781,000 common stock, $5 par, 4,026,000 shares 20,130,000 during 2017, pina did not issue any additional common stock. the following also occurred during 2017. income from continuing operations before taxes $21,950,000 discontinued operations (loss before taxes) $3,505,000 preferred dividends declared $1,078,100 common dividends declared $2,300,000 effective tax rate 35 % compute earnings per share data as it should appear in the 2017 income statement of pina corporation

Answers: 1

You know the right answer?

Whispering Winds Corp. Income Statement For the Year Ended December 31, 2017 Sales revenue Cost of g...

Questions

Mathematics, 28.09.2020 05:01

Mathematics, 28.09.2020 05:01

Mathematics, 28.09.2020 05:01

History, 28.09.2020 05:01

English, 28.09.2020 05:01

Mathematics, 28.09.2020 05:01

Mathematics, 28.09.2020 05:01

Mathematics, 28.09.2020 05:01

Mathematics, 28.09.2020 05:01

Mathematics, 28.09.2020 05:01