Business, 06.05.2020 05:40 Bryson2148

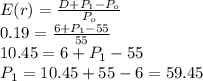

Problem 9-17 Assume that the risk-free rate of interest is 4% and the expected rate of return on the market is 14%. A share of stock sells for $55 today. It will pay a dividend of $6 per share at the end of the year. Its beta is 1.5. What do investors expect the stock to sell for at the end of the year? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Answers: 3

Another question on Business

Business, 21.06.2019 15:20

List three major educational changes over the past 100 years that have positively influenced students. explain why these changes were influential.

Answers: 3

Business, 22.06.2019 11:00

Acoase solution to a problem of externality ensures that a socially efficient outcome is to

Answers: 2

Business, 22.06.2019 13:40

Determine if the following statements are true or false. an increase in government spending can crowd out private investment. an improvement in the budget balance increases the demand for financial capital. an increase in private consumption may crowd out private investment. lower interest rates can lead to private investment being crowded out. a trade balance in sur+ increases the supply of financial capital. if private savings is equal to private investment, then there is neither a budget sur+ nor a budget deficit.

Answers: 1

Business, 23.06.2019 00:30

Emerson has an associate degree based on the chart below how will his employment opportunities change from 2008 to 2018

Answers: 3

You know the right answer?

Problem 9-17 Assume that the risk-free rate of interest is 4% and the expected rate of return on the...

Questions

Spanish, 24.05.2020 01:04

Mathematics, 24.05.2020 01:04

English, 24.05.2020 01:04

Mathematics, 24.05.2020 01:04

History, 24.05.2020 01:04

History, 24.05.2020 01:04

Mathematics, 24.05.2020 01:04

Mathematics, 24.05.2020 01:04

English, 24.05.2020 01:04

Mathematics, 24.05.2020 01:04

Mathematics, 24.05.2020 01:04

Mathematics, 24.05.2020 01:04

Mathematics, 24.05.2020 01:04

)= 4% = 0.04,

)= 4% = 0.04, = 14% = 0.14

= 14% = 0.14 ) = 1.5

) = 1.5 = $55

= $55 ) is given as:

) is given as:

) is given as:

) is given as: