Business, 07.05.2020 06:08 siriuskitwilson9408

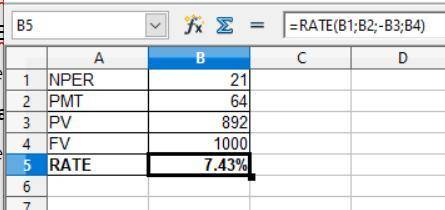

The Pet Market has $1,000 face value bonds outstanding with 21 years to maturity, a coupon rate of 6.4 percent, annual interest payments, and a current price of $892. What is the aftertax cost of debt if the combined tax rate is 21 percent?

Answers: 2

Another question on Business

Business, 22.06.2019 05:50

Cosmetic profits. sally is the executive vice president of big name cosmetics company. through important and material, nonpublic information, she learns that the company is soon going to purchase a smaller chain of stores. it is expected that stock in big name cosmetics will rise dramatically at that point. sally immediately buys a number of shares of her company's stock. she also tells her friend alice about the expected purchase of stores. alice wanted to purchase stock in the company but lacked the funds with which to do so. although she did not have the funds in bank a, alice decided to draw a check on bank a and deposit the check in bank b and then proceed to write a check on bank b to cover the purchase of the stock. she hoped that she would have sufficient funds to deposit before the check was presented for payment. of which of the following offenses, if any, is alice guilty of by buying stock?

Answers: 2

Business, 22.06.2019 08:20

Which change is illustrated by the shift taking place on this graph? a decrease in supply an increase in supply o an increase in demand o a decrease in demand

Answers: 3

Business, 22.06.2019 10:00

You are president of a large corporation. at a typical monthly meeting, each of your vice presidents gives standard area reports. in the past, these reports have been good, and the vps seem satisfied about their work. based on situational approach to leadership, which leadership style should you exhibit at the next meeting?

Answers: 2

Business, 22.06.2019 11:00

You decide to invest in a portfolio consisting of 25 percent stock a, 25 percent stock b, and the remainder in stock c. based on the following information, what is the expected return of your portfolio? state of economy probability of state return if state occurs of economy stock a stock b stock c recession .16 - 16.4 % - 2.7 % - 21.6 % normal .55 12.6 % 7.3 % 15.9 % boom .29 26.2 % 14.6 % 30.5 %

Answers: 1

You know the right answer?

The Pet Market has $1,000 face value bonds outstanding with 21 years to maturity, a coupon rate of 6...

Questions

Physics, 10.09.2020 04:01

Mathematics, 10.09.2020 04:01

Mathematics, 10.09.2020 04:01

History, 10.09.2020 04:01

Mathematics, 10.09.2020 04:01

Biology, 10.09.2020 04:01

Mathematics, 10.09.2020 04:01

Mathematics, 10.09.2020 04:01

Mathematics, 10.09.2020 04:01

Mathematics, 10.09.2020 04:01

Mathematics, 10.09.2020 04:01

Arts, 10.09.2020 04:01

Mathematics, 10.09.2020 04:01

Mathematics, 10.09.2020 04:01

History, 10.09.2020 04:01

Mathematics, 10.09.2020 04:01

Mathematics, 10.09.2020 04:01

Mathematics, 10.09.2020 04:01

Mathematics, 10.09.2020 04:01

Physics, 10.09.2020 04:01