Business, 21.05.2020 01:07 alishajade

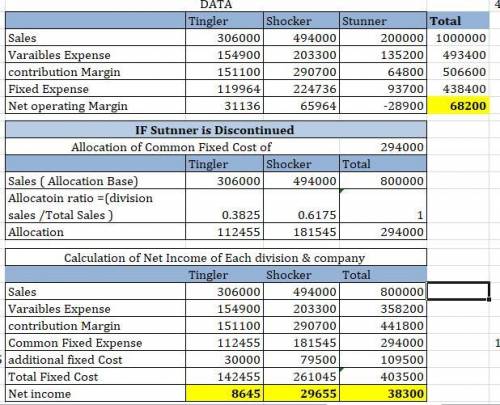

Cullumber Company makes three models of tasers. Information on the three products is given below. Tingler Shocker Stunner Sales $306,000 $494,000 $200,000 Variable expenses 154,900 203,300 135,200 Contribution margin 151,100 290,700 64,800 Fixed expenses 119,964 224,736 93,700 Net income $31,136 $65,964 $(28,900) Fixed expenses consist of $294,000 of common costs allocated to the three products based on relative sales, as well as direct fixed expenses unique to each model of $30,000 (Tingler), $79,500 (Shocker), and $34,900 (Stunner). The common costs will be incurred regardless of how many models are produced. The direct fixed expenses would be eliminated if that model is phased out. James Watt, an executive with the company, feels the Stunner line should be discontinued to increase the company’s net income. (a) Compute current net income for Cullumber Company. Net income $ (b) Compute net income by product line and in total for Cullumber Company if the company discontinues the Stunner product line. (Hint: Allocate the $294,000 common costs to the two remaining product lines based on their relative sales.) Tingler Net Income $ Shocker Net Income $ Total Net Income $ (c) Should Cullumber eliminate the Stunner product line? Why or why not? Net income would from $ to $ .

Answers: 2

Another question on Business

Business, 21.06.2019 22:20

Amachine purchased three years ago for $720,000 has a current book value using straight-line depreciation of $400,000: its operating expenses are $60,000 per year. a replacement machine would cost $480,000, have a useful life of nine years, and would require $26,000 per year in operating expenses. it has an expected salvage value of $130,000 after nine years. the current disposal value of the old machine is $170,000: if it is kept 9 more years, its residual value would be $20,000. calculate the total costs in keeping the old machine and purchase a new machine. should the old machine be replaced?

Answers: 2

Business, 22.06.2019 02:00

On january 1, 2017, fisher corporation purchased 40 percent (90,000 shares) of the common stock of bowden, inc. for $980,000 in cash and began to use the equity method for the investment. the price paid represented a $48,000 payment in excess of the book value of fisher's share of bowden's underlying net assets. fisher was willing to make this extra payment because of a recently developed patent held by bowden with a 15-year remaining life. all other assets were considered appropriately valued on bowden's books. bowden declares and pays a $90,000 cash dividend to its stockholders each year on september 15. bowden reported net income of $400,000 in 2017 and $348,000 in 2018. each income figure was earned evenly throughout its respective year. on july 1, 2018, fisher sold 10 percent (22,500 shares) of bowden's outstanding shares for $338,000 in cash. although it sold this interest, fisher maintained the ability to significantly influence bowden's decision-making process. prepare the journal entries for fisher for the years of 2017 and 2018. (if no entry is required for a transaction/event, select "no journal entry required" in the first account field. do not round intermediate calculations. round your final answers to the nearest whole dollar.)

Answers: 3

Business, 22.06.2019 10:00

Your father offers you a choice of $120,000 in 11 years or $48,500 today. use appendix b as an approximate answer, but calculate your final answer using the formula and financial calculator methods. a-1. if money is discounted at 11 percent, what is the present value of the $120,000?

Answers: 3

Business, 22.06.2019 12:30

Amap from a trade development commission or chamber of commerce can be more useful than google maps for identifying

Answers: 1

You know the right answer?

Cullumber Company makes three models of tasers. Information on the three products is given below. Ti...

Questions

Mathematics, 29.04.2021 21:00

Mathematics, 29.04.2021 21:00

English, 29.04.2021 21:00

English, 29.04.2021 21:00

Mathematics, 29.04.2021 21:00

Biology, 29.04.2021 21:00

Mathematics, 29.04.2021 21:00

Chemistry, 29.04.2021 21:00

Mathematics, 29.04.2021 21:00

Mathematics, 29.04.2021 21:00

Mathematics, 29.04.2021 21:00

Mathematics, 29.04.2021 21:00

Mathematics, 29.04.2021 21:00