Waterways puts much emphasis on cash flow when it plans for capital investments. The company chose its discount rate of 8% based on the rate of return it must pay its owners and creditors. Using that rate, Waterways then uses different methods to determine the best decisions for making capital outlays. This year Waterways is considering buying five new backhoes to replace the backhoes it now has. The new backhoes are faster, cost less to run, provide for more accurate trench digging, have comfort features for the operators, and have 1-year maintenance agreements to go with them. The old backhoes are working just fine, but they do require considerable maintenance. The backhoe operators are very familiar with the old backhoes and would need to learn some new skills to use the new backhoes. The following information is available to use in deciding whether to purchase the new backhoes.

Old Backhoes New Backhoes

Purchase cost when new $90,000 $202,784

Salvage value now $41,600

Investment in major overhaul needed in next year $55,510

Salvage value in 8 years $15,000 $90,000

Remaining life 8 years 8 years

Net cash flow generated each year $30,500 $43,800

(a) Evaluate in the following ways whether to purchase the new equipment or overhaul the old equipment. (Hint: For the old machine, the initial investment is the cost of the overhaul. For the new machine, subtract the salvage value of the old machine to determine the initial cost of the investment.)

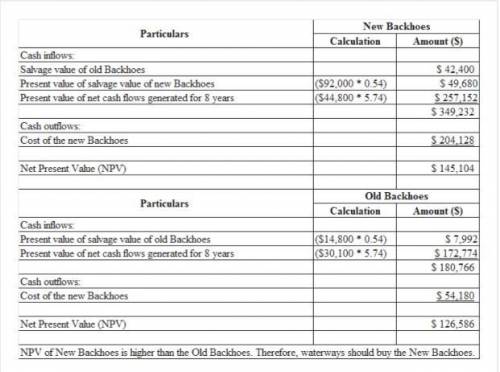

(1) Using the net present value method for buying new or keeping the old

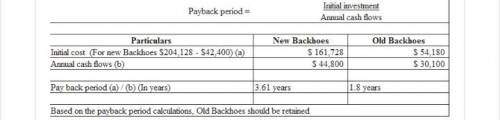

(2) Using the payback method for each choice. (Hint: For the old machine, evaluate the payback of an overhaul.)

(3) Comparing the profitability index for each choice.

(4) Calculate the internal rate of return factor for the new and old blackhoes.

(5) Comparing the internal rate of return for each choice to the required 8% discount rate.

Answers: 3

Another question on Business

Business, 22.06.2019 06:10

Information on gerken power co., is shown below. assume the company’s tax rate is 40 percent. debt: 9,400 8.4 percent coupon bonds outstanding, $1,000 par value, 21 years to maturity, selling for 100.5 percent of par; the bonds make semiannual payments. common stock: 219,000 shares outstanding, selling for $83.90 per share; beta is 1.24. preferred stock: 12,900 shares of 5.95 percent preferred stock outstanding, currently selling for $97.10 per share. market: 7.2 percent market risk premium and 5 percent risk-free rate. required: calculate the company's wacc. (do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) wacc %

Answers: 2

Business, 22.06.2019 18:00

When peter metcalf describes black diamond’s manufacturing facility in china as a “greenfield project,” he means that partnered with a chinese company to buy the plant . of all market entry strategies, this one carries the lowest risk. because black diamond manufactures its outdoor sports products outside the united states, what risks must its managers be aware of?

Answers: 1

Business, 23.06.2019 00:50

On december 31 of the current year, the unadjusted trial balance of a company using the percent of receivables method to estimate bad debt included the following: accounts receivable, debit balance of $97,900; allowance for doubtful accounts, credit balance of $1,031. what amount should be debited to bad debts expense, assuming 6% of outstanding accounts receivable at the end of the current year are estimated to be uncollectible?

Answers: 1

Business, 23.06.2019 01:50

Exhibit 34-1 country a country b good x 90 60 30 0 good ygood x good y 0 30 60 90 30 20 10 20 40 60 refer to exhibit 34-1. considering the data, which of the following term to? a. 1 unit of y for 1 unit of x b. 1 unit of y for 0.75 units of x c. 1 unit of y for 0.25 units of x d. 1 unit of y for 1.50 units of x e. all of the above s of trade would both countries agree 8. it -

Answers: 2

You know the right answer?

Waterways puts much emphasis on cash flow when it plans for capital investments. The company chose i...

Questions

Mathematics, 22.02.2022 17:10

Chemistry, 22.02.2022 17:10

Chemistry, 22.02.2022 17:10

Mathematics, 22.02.2022 17:10

Biology, 22.02.2022 17:10

Mathematics, 22.02.2022 17:10

Arts, 22.02.2022 17:10

Mathematics, 22.02.2022 17:10

Mathematics, 22.02.2022 17:10

Mathematics, 22.02.2022 17:20