Business, 24.05.2020 02:00 wedderman8292

Synthetic Fuels Corporation prepares its financial statements according to IFRS. On June 30, 2019, the company purchased equipment for $540,000. The equipment is expected to have a five-year useful life with no residual value. Synthetic uses the straight-line depreciation method for all depreciable assets and chooses to revalue the equipment. Fair value of the equipment was $524,880 at 12/31/2019 and $354,348 at 12/31/2020, respectively.

Required:

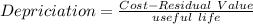

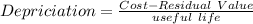

1. Calculate the depreciation for 2019 and prepare the journal entry to record it.

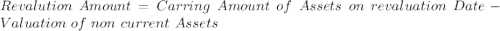

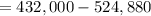

2. Prepare the journal entry to record the revaluation of the equipment at 12/31/2019 (Show supporting calculations).

3. Calculate the depreciation for 2020 and prepare the journal entry to record it.

4. Prepare the journal entry to record the revaluation of the equipment at 12/31/2020 (Show supporting calculations).

Answers: 1

Another question on Business

Business, 22.06.2019 03:00

If you were running a company, what are at least two things you could do to improve its productivity.

Answers: 1

Business, 22.06.2019 06:30

Select all that apply. select the ways that labor unions can increase wages. collective bargaining reducing the labor supply increasing the demand for labor creating monopolies

Answers: 1

Business, 22.06.2019 11:10

Which of the following is an example of a production quota? a. the government sets an upper limit on the quantity that each dairy farmer can produce. b. the government sets a price floor in the market for dairy products. c. the government sets a lower limit on the quantity that each dairy farmer can produce. d. the government guarantees to buy a specified quantity of dairy products from farmers.

Answers: 2

Business, 22.06.2019 14:30

If a product goes up in price, and the demand for it drops, that product's demand is a. elastic b. inelastic c. stable d. fixed select the best answer from the choices provided

Answers: 1

You know the right answer?

Synthetic Fuels Corporation prepares its financial statements according to IFRS. On June 30, 2019, t...

Questions

Advanced Placement (AP), 23.10.2020 01:01

Mathematics, 23.10.2020 01:01

Physics, 23.10.2020 01:01

Mathematics, 23.10.2020 01:01

Mathematics, 23.10.2020 01:01

Mathematics, 23.10.2020 01:01

Mathematics, 23.10.2020 01:01

Mathematics, 23.10.2020 01:01

Mathematics, 23.10.2020 01:01

Geography, 23.10.2020 01:01

Mathematics, 23.10.2020 01:01

Mathematics, 23.10.2020 01:01

Physics, 23.10.2020 01:01

Social Studies, 23.10.2020 01:01

(Gained revaluation)

(Gained revaluation)

(Loss revaluation)

(Loss revaluation)