Business, 27.05.2020 21:58 williamslyric

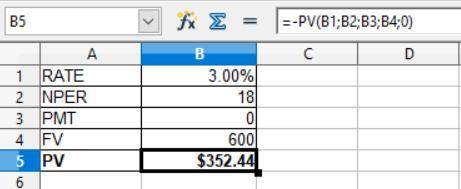

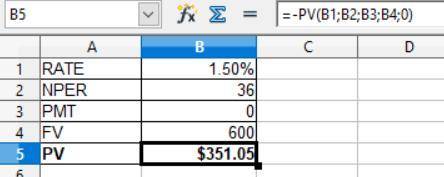

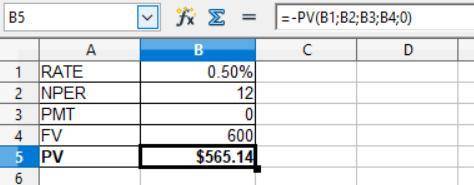

Find the present value of $600 due in the future under each of these conditions: 6% nominal rate, semiannual compounding, discounted back 9 years. Round your answer to the nearest cent. $ 6% nominal rate, quarterly compounding, discounted back 9 years. Round your answer to the nearest cent. $ 6% nominal rate, monthly compounding, discounted back 1 year. Round your answer to the nearest cent. $ Why do the differences in the PVs occur

Answers: 1

Another question on Business

Business, 22.06.2019 13:30

The purpose of safety stock is to: a. eliminate the possibility of a stockout. b. control the likelihood of a stockout due to variable demand and/or lead time. c. eliminate the likelihood of a stockout due to erroneous inventory tally. d. protect the firm from a sudden decrease in demand. e. replace failed units with good ones.

Answers: 1

Business, 22.06.2019 13:40

The cook corporation has two divisions--east and west. the divisions have the following revenues and expenses: east west sales $ 603,000 $ 506,000 variable costs 231,000 300,000 traceable fixed costs 151,500 192,000 allocated common corporate costs 128,600 156,000 net operating income (loss) $ 91,900 $ (142,000 ) the management of cook is considering the elimination of the west division. if the west division were eliminated, its traceable fixed costs could be avoided. total common corporate costs would be unaffected by this decision. given these data, the elimination of the west division would result in an overall company net operating income (loss)

Answers: 1

Business, 22.06.2019 21:20

Rediger inc., a manufacturing corporation, has provided the following data for the month of june. the balance in the work in process inventory account was $28,000 at the beginning of the month and $20,000 at the end of the month. during the month, the corporation incurred direct materials cost of $56,200 and direct labor cost of $29,800. the actual manufacturing overhead cost incurred was $53,600. the manufacturing overhead cost applied to work in process was $52,200. the cost of goods manufactured for june was:

Answers: 2

You know the right answer?

Find the present value of $600 due in the future under each of these conditions: 6% nominal rate, se...

Questions

Biology, 19.10.2019 01:50

Mathematics, 19.10.2019 01:50

Mathematics, 19.10.2019 01:50

History, 19.10.2019 01:50

English, 19.10.2019 01:50

Mathematics, 19.10.2019 01:50

Social Studies, 19.10.2019 02:00

Business, 19.10.2019 02:00

Mathematics, 19.10.2019 02:00

History, 19.10.2019 02:00

Mathematics, 19.10.2019 02:00