Business, 27.05.2020 12:57 eweqwee3147

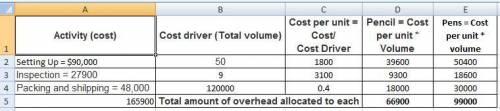

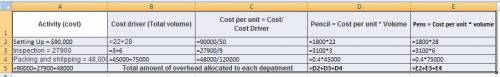

Isadore’s Implements, Inc., manufactures pens and mechanical pencils often used for gifts. Overhead costs are currently allocated using direct labor-hours, but the controller has recommended an activity-based costing system using the following data: Cost Driver Volume Activity Cost Driver Cost Pencils Pens Setting up Number of setups $ 90,000 22 28 Inspecting Number of parts 27,900 3 6 Packing and shipping Number of boxes shipped 48,000 45,000 75,000 Total overhead $ 165,900 Required: a. Compute the amount of overhead to be allocated to each product under activity-based costing. (Do not round intermediate calculations.)

Answers: 3

Another question on Business

Business, 21.06.2019 23:00

What is overdraft protection (odp)? a.) a cheap and easy way to always avoid overdrawing a bank account b.) a service to automatically transfer available funds from a linked account to cover purchases, prevent returned checks and declined items when you don’t have enough money in your checking account at the time of the transaction. c.) an insurance policy sold by banks to prevent others from withdrawing your money d.) a service provided by the government that insures individuals bank deposits up to $250,000

Answers: 2

Business, 22.06.2019 15:10

On december 31, 2013, coronado company issues 173,000 stock-appreciation rights to its officers entitling them to receive cash for the difference between the market price of its stock and a pre-established price of $10. the fair value of the sars is estimated to be $5 per sar on december 31, 2014; $2 on december 31, 2015; $10 on december 31, 2016; and $8 on december 31, 2017. the service period is 4 years, and the exercise period is 7 years. prepare a schedule that shows the amount of compensation expense allocable to each year affected by the stock-appreciation rights plan.

Answers: 2

Business, 22.06.2019 17:10

Storico co. just paid a dividend of $3.15 per share. the company will increase its dividend by 20 percent next year and then reduce its dividend growth rate by 5 percentage points per year until it reaches the industry average of 5 percent dividend growth, after which the company will keep a constant growth rate forever. if the required return on the company’s stock is 12 percent, what will a share of stock sell for today?

Answers: 1

Business, 22.06.2019 22:40

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 10 percent, and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years, respectively. use the irr decision to evaluate this project; should it be accepted or rejected

Answers: 3

You know the right answer?

Isadore’s Implements, Inc., manufactures pens and mechanical pencils often used for gifts. Overhead...

Questions

History, 04.11.2019 02:31

Mathematics, 04.11.2019 02:31

History, 04.11.2019 02:31

Biology, 04.11.2019 02:31

Mathematics, 04.11.2019 02:31

Mathematics, 04.11.2019 02:31

Mathematics, 04.11.2019 02:31

Social Studies, 04.11.2019 02:31

History, 04.11.2019 02:31

Social Studies, 04.11.2019 02:31