Business, 31.05.2020 01:02 earthangel456

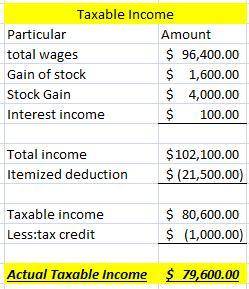

Bob Katz and Sally Mander are a married couple with four children. Total wages for 2018 equaled $96,400. Stock which had been purchased nine months earlier was sold for a $1,600 gain and stock held for three years was sold for a $4,000 gain. Interest income from savings was $100. Itemized deductions totaled $21,500. Bob and Sally qualify for a $1,000 tax credit. What is Bob's and Sally's taxable income

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

Which of the following government agencies is responsible for managing the money supply in the united states? a. the u.s. mint b. the federal reserve bank c. congress d. the department of the treasury 2b2t

Answers: 3

Business, 22.06.2019 02:20

Each month, business today publishes a news piece about an innovative product, service, or business. such soft news is generally written by a freelance business writer and is known as a

Answers: 2

Business, 22.06.2019 05:20

142"what is the value of n? soefon11402bebe99918+19: 00esseeshop60-990 0esle

Answers: 1

You know the right answer?

Bob Katz and Sally Mander are a married couple with four children. Total wages for 2018 equaled $96,...

Questions

Engineering, 16.11.2020 19:50

Physics, 16.11.2020 19:50

English, 16.11.2020 19:50

Social Studies, 16.11.2020 19:50

English, 16.11.2020 19:50

Arts, 16.11.2020 19:50

Mathematics, 16.11.2020 19:50

History, 16.11.2020 19:50

Chemistry, 16.11.2020 19:50

Mathematics, 16.11.2020 19:50

History, 16.11.2020 19:50