Business, 31.05.2020 03:00 kprincess16r

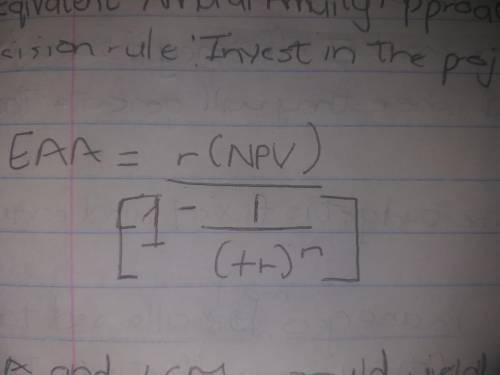

Platinum, Inc. is considering two mutually exclusive projects, X and Y. Project X costs $95,000 today and is expected to generate $65,000 in year one and $75,000 in year two. Project Y costs $120,000 and is expected to generate $64,000 in year one, $67,000 in year two, $56,000 in year three, and $45,000 in year four. The firm's investors require a rate of return of 15% and the weighted average cost of capital is 12%. What is the equivalent annual annuity for Project Y needed to compare the two projects

Answers: 1

Another question on Business

Business, 22.06.2019 03:00

In the supply-and-demand schedule shown above, at the lowest price of $50, producers supply music players and consumers demand music players.

Answers: 2

Business, 22.06.2019 10:10

An investment offers a total return of 18 percent over the coming year. janice yellen thinks the total real return on this investment will be only 14 percent. what does janice believe the inflation rate will be over the next year?

Answers: 3

Business, 22.06.2019 11:00

Acoase solution to a problem of externality ensures that a socially efficient outcome is to

Answers: 2

Business, 22.06.2019 16:20

Suppose you hold a portfolio consisting of a $10,000 investment in each of 8 different common stocks. the portfolio's beta is 1.25. now suppose you decided to sell one of your stocks that has a beta of 1.00 and to use the proceeds to buy a replacement stock with a beta of 1.55. what would the portfolio's new beta be? do not round your intermediate calculations.

Answers: 2

You know the right answer?

Platinum, Inc. is considering two mutually exclusive projects, X and Y. Project X costs $95,000 toda...

Questions

Mathematics, 01.09.2020 04:01

Mathematics, 01.09.2020 04:01

Social Studies, 01.09.2020 04:01

Mathematics, 01.09.2020 04:01

Mathematics, 01.09.2020 04:01

Chemistry, 01.09.2020 04:01

Business, 01.09.2020 04:01

English, 01.09.2020 04:01

Mathematics, 01.09.2020 04:01

Mathematics, 01.09.2020 04:01

Biology, 01.09.2020 04:01

Mathematics, 01.09.2020 04:01

History, 01.09.2020 04:01