Business, 03.06.2020 02:57 changav36832

At the beginning of the year, Infodeo established its predetermined overhead rate for movies produced during the year by using the following cost predictions: overhead costs, $2,000,000,and direct labor costs, $500,000. At year-end, the companyâs records show that actual overhead costs for the year are $949,700.

Actual direct labor cost had been assigned to jobs as follows.

Movies completed and released $400,000

Movies still in production 36,000

Total actual direct labor cost $436,000

Required:

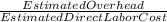

1) Determine the predetermined overhead rate for the year.

2) Enter the overhead costs incurred and the amounts applied during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplied.

3) Prepare the adjusting entry to allocate any over or underapplied overhead to Cost of Goods Sold.

Answers: 2

Another question on Business

Business, 21.06.2019 16:00

The proliferation of bittorrent and other file sharing media have threatened the copyright system. based on an understanding of incentives and opportunity cost, how are the decisions of musicians likely impacted?

Answers: 2

Business, 21.06.2019 23:00

What is overdraft protection (odp)? a.) a cheap and easy way to always avoid overdrawing a bank account b.) a service to automatically transfer available funds from a linked account to cover purchases, prevent returned checks and declined items when you don’t have enough money in your checking account at the time of the transaction. c.) an insurance policy sold by banks to prevent others from withdrawing your money d.) a service provided by the government that insures individuals bank deposits up to $250,000

Answers: 2

Business, 22.06.2019 10:50

Melissa is a very generous single woman. before this year, she had given over $11,400,000 in taxable gifts over the years and has completely exhausted her applicable credit amount. in the current year, melissa gave her daughter riley $100,000 and promptly filed her gift tax return. melissa did not make any other gifts this year. how much gift tax must riley pay the irs because of this transaction?

Answers: 2

Business, 22.06.2019 19:00

Consider the following information on stocks a, b, c and their returns (in decimals) in each state: state prob. of state a b c boom 20% 0.27 0.22 0.16 good 45% 0.16 0.09 0.07 poor 25% 0.03 0 0.03 bust 10% -0.08 -0.04 -0.02 if your portfolio is invested 25% in a, 40% in b, and 35% in c, what is the standard deviation of the portfolio in percent? answer to two decimals, carry intermediate calcs. to at least four decimals.

Answers: 2

You know the right answer?

At the beginning of the year, Infodeo established its predetermined overhead rate for movies produce...

Questions

SAT, 05.11.2020 03:30

Advanced Placement (AP), 05.11.2020 03:30

Mathematics, 05.11.2020 03:30

Mathematics, 05.11.2020 03:30

English, 05.11.2020 03:30

Mathematics, 05.11.2020 03:30

Mathematics, 05.11.2020 03:30

Spanish, 05.11.2020 03:30

Mathematics, 05.11.2020 03:30

Chemistry, 05.11.2020 03:30

Biology, 05.11.2020 03:30

× 100

× 100 × 100 = 400%

× 100 = 400%