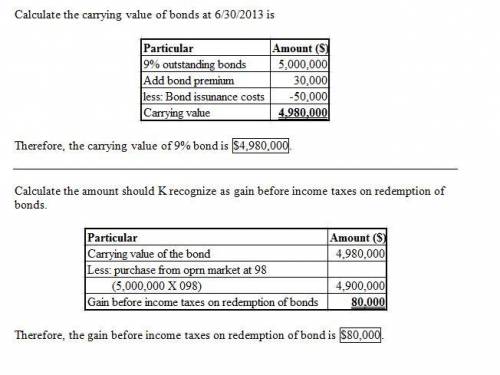

On June 30, Year 7, King Co. had outstanding 9%, $5,000,000 face value bonds maturing on June 30, Year 9. Interest was payable semiannually every June 30 and December 31. On June 30, Year 7, after amortization was recorded for the period, the unamortized bond premium was $30,000. On that date, King acquired all its outstanding bonds on the open market at 93 and retired them. At June 30, Year 7, what amount should King recognize as gain before income taxes on redemption of bonds

Answers: 2

Another question on Business

Business, 22.06.2019 06:40

Self-interest achieve society’s economic goals because producers know which goods consumers want the most. as consumers and producers exercise their freedom to act in their own self-interest, markets will produce the desired goods at the lowest possible cost. consumers and producers both operate based on society’s economic goals. consumers know which goods can be produced at the lowest cost. there is a wide variety of desired goods and services in a market system because producers determine what to produce. consumers change their minds frequently. there is always a need to produce something new and improved. individual wants are diverse. what is produced is ultimately determined by consumers, because if the goods offered are not what consumers want, consumers will not buy them. producers, because they are driven by profits. producers, because they determine what to produce. consumers, because they participate in marketing surveys.

Answers: 2

Business, 22.06.2019 07:30

When selecting a savings account, you should look at the following factors except annual percentage yield (apy) fees minimum balance interest thresholds taxes paid on the interest variable interest rates

Answers: 1

Business, 22.06.2019 22:00

On january 8, the end of the first weekly pay period of the year, regis company's payroll register showed that its employees earned $22,760 of office salaries and $70,840 of sales salaries. withholdings from the employees' salaries include fica social security taxes at the rate of 6.20%, fica medicare taxes at the rate of 1.45%, $13,260 of federal income taxes, $1,450 of medical insurance deductions, and $860 of union dues. no employee earned more than $7,000 in this first pay period. required: 1.1 calculate below the amounts for each of these four taxes of regis company. regis’s merit rating reduces its state unemployment tax rate to 3% of the first $7,000 paid to each employee. the federal unemployment tax rate is 0.60

Answers: 3

Business, 22.06.2019 22:30

Which of the following describes one of the ways that the demographics of an area affect the price of housing in that area? a. when more people have children, their incomes tend to be higher and the housing prices are also higher. b. older people are more likely to stay in their houses, creating a seller's market that keeps prices low. c. an area with a lower population density won't have enough construction workers to build new houses quickly. d. an area with younger people will have a higher demand for rentals and a lower demand for buying.

Answers: 1

You know the right answer?

On June 30, Year 7, King Co. had outstanding 9%, $5,000,000 face value bonds maturing on June 30, Ye...

Questions

Biology, 26.01.2021 17:00

Mathematics, 26.01.2021 17:00

Computers and Technology, 26.01.2021 17:00

Geography, 26.01.2021 17:00

Biology, 26.01.2021 17:00

Mathematics, 26.01.2021 17:00

Mathematics, 26.01.2021 17:00

Mathematics, 26.01.2021 17:00

Mathematics, 26.01.2021 17:00

English, 26.01.2021 17:00