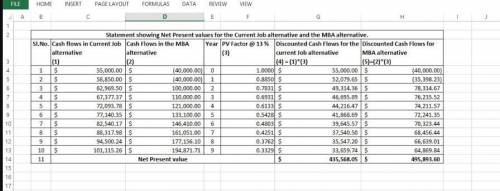

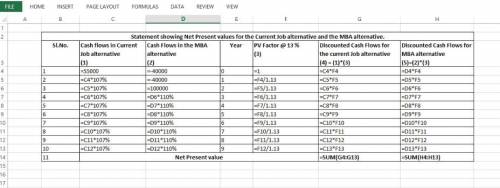

A prospective MBA student earns $55,000 per year in her current job and expects that amount to increase by 7% per year. She is considering leaving her job to attend business school for two years at a cost of $40,000 per year. She has been told that her starting salary after business school is likely to be $100,000 and that amount will increase by 10% per year. Consider a time horizon of 10 years, use a discount rate of 13%, and ignore all considerations not explicitly mentioned here.

Assume all cash flows occur at the start of each year (i. e., immediate, one year from now, two years from now,..., nine years from now). Also assume that the choice can be implemented immediately so that for the MBA alternative the current year is the first year of business school.

What is the net present value of the more attractive alternative?

Please round your answer to the nearest dollar.

Answers: 3

Another question on Business

Business, 21.06.2019 19:20

Astock with a beta of 0.6 has an expected rate of return of 13%. if the market return this year turns out to be 10 percentage points below expectations, what is your best guess as to the rate of return on the stock? (do not round intermediate calculations. enter your answer as a percent rounded to 1 decimal place.)

Answers: 2

Business, 22.06.2019 10:30

When sending a claim to an insurance company for services provided by the physician, why are both icd-10 and cpt codes required to be submitted? how are these codes dependent upon each other? what would be the result of not submitting both codes on a medical claim to an insurance company?

Answers: 2

Business, 22.06.2019 17:30

Danielle enjoys working as a certified public accountant (cpa) and assisting small businesses and individuals with managing their finances and taxes. which general area of accounting is her specialty? danielle specialized in

Answers: 1

Business, 22.06.2019 22:20

Which of the following is correct? a. a tax burden falls more heavily on the side of the market that is more elastic.b. a tax burden falls more heavily on the side of the market that is less elastic.c. a tax burden falls more heavily on the side of the market that is closer to unit elastic.d. a tax burden is distributed independently of the relative elasticities of supply and demand.

Answers: 1

You know the right answer?

A prospective MBA student earns $55,000 per year in her current job and expects that amount to incre...

Questions

Mathematics, 07.09.2021 02:50

Mathematics, 07.09.2021 02:50

Mathematics, 07.09.2021 02:50

Mathematics, 07.09.2021 02:50

Mathematics, 07.09.2021 02:50

Physics, 07.09.2021 02:50

Mathematics, 07.09.2021 02:50

Mathematics, 07.09.2021 02:50

Mathematics, 07.09.2021 02:50