Business, 07.06.2020 05:01 jholland03

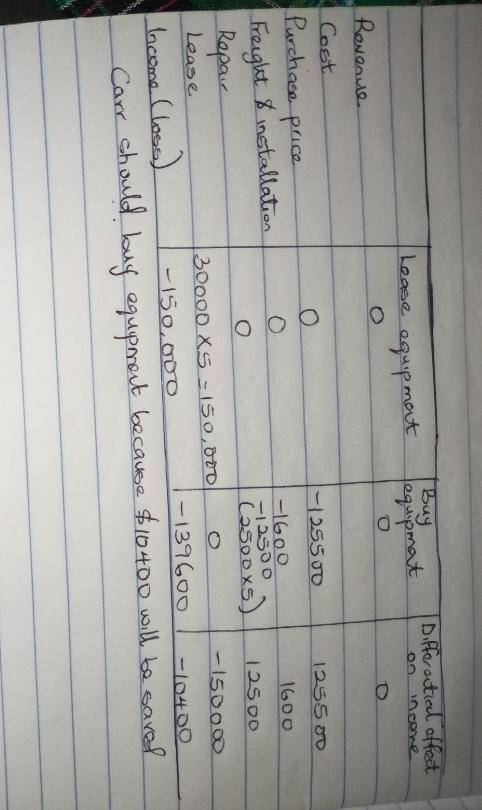

Differential Analysis for a Lease or Buy Decision Sloan Corporation is considering new equipment. The equipment can be purchased from an overseas supplier for $125,500. The freight and installation costs for the equipment are $1,600. If purchased, annual repairs and maintenance are estimated to be $2,500 per year over the five-year useful life of the equipment. Alternatively, Sloan can lease the equipment from a domestic supplier for $30,000 per year for five years, with no additional costs. Prepare a differential analysis dated December 3 to determine whether Sloan should lease (Alternative 1) or purchase (Alternative 2) the equipment. Hint: This is a "lease or buy" decision, which must be analyzed from the perspective of the equipment user, as opposed to the equipment owner. If an amount is zero, enter "0". Use a minus sign to indicate a loss. Differential Analysis Lease Equipment (Alt. 1) or Buy Equipment (Alt. 2) December 3 Lease Equipment (Alternative 1) Buy Equipment (Alternative 2) Differential Effect on Income (Alternative 2) Revenues $ $ $ Costs: Purchase price $ $ $ Freight and installation Repair and maintenance (5 years) Lease (5 years) Income (loss) $ $ $ Determine whether Carr should lease (Alternative 1) or buy (Alternative 2) the equipment.

Answers: 1

Another question on Business

Business, 21.06.2019 19:30

Maker-bot corporation has 10,000 shares of 10%, $90 par value, cumulative preferred stock outstanding since its inception. no dividends were declared in the first two years. if the company pays $400,000 of dividends in the third year, how much will common stockholders receive?

Answers: 2

Business, 22.06.2019 05:50

Which is one solution to levy the complexity of the global matrix strategy with added customer-focused dimensions?

Answers: 3

Business, 22.06.2019 12:20

Selected transactions of the carolina company are listed below. classify each transaction as either an operating activity, an investing activity, a financing activity, or a noncash activity. 1. common stock is sold for cash above par value. 2. bonds payable are issued for cash at a discount

Answers: 2

Business, 22.06.2019 13:20

Suppose your rich uncle gave you $50,000, which you plan to use for graduate school. you will make the investment now, you expect to earn an annual return of 6%, and you will make 4 equal annual withdrawals, beginning 1 year from today. under these conditions, how large would each withdrawal be so there would be no funds remaining in the account after the 4th withdraw?

Answers: 3

You know the right answer?

Differential Analysis for a Lease or Buy Decision Sloan Corporation is considering new equipment. Th...

Questions

Mathematics, 13.10.2019 07:50

Mathematics, 13.10.2019 07:50

Health, 13.10.2019 07:50

Mathematics, 13.10.2019 07:50

Biology, 13.10.2019 07:50

History, 13.10.2019 07:50

Mathematics, 13.10.2019 07:50

Physics, 13.10.2019 07:50

English, 13.10.2019 07:50

English, 13.10.2019 07:50

Mathematics, 13.10.2019 07:50

Mathematics, 13.10.2019 07:50

Physics, 13.10.2019 07:50