Business, 10.06.2020 18:57 mwest200316

Acquisition of Land and Building

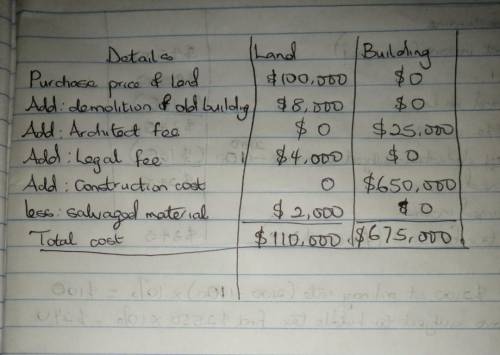

On February 1, 2016, Edwards Corporation purchased a parcel of land as a factory site for $100,000. It demolished an old building on the property and began construction on a new building that was completed on October 2, 2016. Costs incurred during this period are:

Demolition of old building $8,000

Architect’s fees 25,000

Legal fees for title investigation and purchase contract 4,000

Construction costs 650,000

Edwards sold salvaged materials resulting from the demolition for $2,000.

Required:

At what amount should Edwards record the cost of the land and the new building, respectively?

If an input box should be blank, enter a zero.

Land Building

Purchase price of land $ $

Demolition of old building

Architect's fees

Legal fees

Construction costs

Salvaged materials

Total

Answers: 3

Another question on Business

Business, 21.06.2019 21:30

The following balance sheet for the los gatos corporation was prepared by a recently hired accountant. in reviewing the statement you notice several errors. los gatos corporation balance sheet at december 31, 2018 assets cash $ 44,000 accounts receivable 86,000 inventories 57,000 machinery (net) 122,000 franchise (net) 32,000 total assets $ 341,000 liabilities and shareholders' equity accounts payable $ 54,000 allowance for uncollectible accounts 7,000 note payable 59,000 bonds payable 112,000 shareholders' equity 109,000 total liabilities and shareholders' equity $ 341,000 additional information: cash includes a $22,000 restricted amount to be used for repayment of the bonds payable in 2022. the cost of the machinery is $194,000. accounts receivable includes a $22,000 note receivable from a customer due in 2021. the note payable includes accrued interest of $7,000. principal and interest are both due on february 1, 2019. the company began operations in 2013. income less dividends since inception of the company totals $37,000. 52,000 shares of no par common stock were issued in 2013. 200,000 shares are authorized. required: prepare a corrected, classified balance sheet. (amounts to be deducted should be indicated by a minus sign.)

Answers: 2

Business, 22.06.2019 06:50

On january 1, vermont corporation had 40,000 shares of $10 par value common stock issued and outstanding. all 40,000 shares has been issued in a prior period at $20.00 per share. on february 1, vermont purchased 3,750 shares of treasury stock for $24 per share and later sold the treasury shares for $21 per share on march 1. the journal entry to record the purchase of the treasury shares on february 1 would include a credit to treasury stock for $90,000 debit to treasury stock for $90,000 credit to a gain account for $112,500 debit to a loss account for $112,500

Answers: 3

Business, 22.06.2019 11:00

The following transactions occurred during july: received $1,000 cash for services provided to a customer during july. received $4,000 cash investment from bob johnson, the owner of the business received $850 from a customer in partial payment of his account receivable which arose from sales in june. provided services to a customer on credit, $475. borrowed $7,000 from the bank by signing a promissory note. received $1,350 cash from a customer for services to be rendered next year. what was the amount of revenue for july?

Answers: 1

You know the right answer?

Acquisition of Land and Building

On February 1, 2016, Edwards Corporation purchased a parcel of lan...

Questions

Health, 04.06.2020 22:01

Biology, 04.06.2020 22:01

Mathematics, 04.06.2020 22:01

English, 04.06.2020 22:01

Mathematics, 04.06.2020 22:01

Physics, 04.06.2020 22:01

Computers and Technology, 04.06.2020 22:01

Chemistry, 04.06.2020 22:01

Mathematics, 04.06.2020 22:01

Mathematics, 04.06.2020 22:01

Mathematics, 04.06.2020 22:01