Business, 13.06.2020 22:57 miafluellen

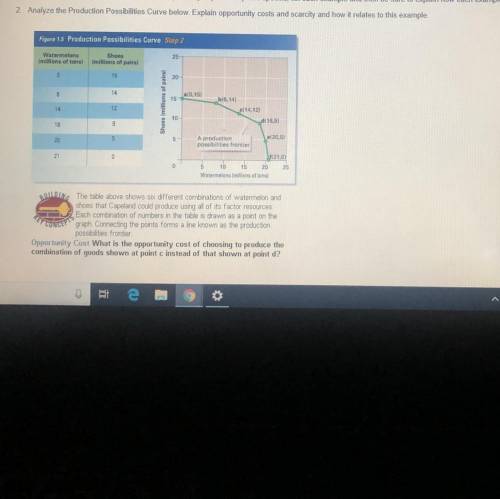

Analyze the Production Possibilities Curve below. Explain opportunity costs and scarcity and how it relates to this example

Figure 1.5 Production Possibilities Curve Sis2

Watermelons

lions of tons

25

Shoes

millions of pales

15

20

3

14

10.15)

Shoes (millions of pairal

15

b18,14)

14

12

114,12

10

18

d118,9)

120,51

A production

possibilities frontier

22

121,0

10 1

20 25

Wistermelons millions of tons)

Answers: 2

Another question on Business

Business, 21.06.2019 19:10

The development price itself is such a huge barrier, it's just a very different business model than boeing's used to. our huge development programs are typically centered around commercial airplanes, military aircraft, where there is a lot of orders. and right now the foundation of the business is two bites a year.

Answers: 3

Business, 22.06.2019 09:40

As related to a company completing the purchase to pay process, is there an accounting journal entry "behind the scenes" when xyz company pays for the goods within 10 days of the invoice (gross method is used for discounts and terms are 2/10 net 30) that updates the general ledger?

Answers: 3

Business, 22.06.2019 21:00

Identify whether the statements are true or false by dragging and dropping the appropriate term into the bin provided. long-run economic growth is unlikely to be sustainable because of finite natural resources. in the modern economy, countries that possess few domestic natural resources essentially have no chance to develop economically. finding alternatives to natural resources will be very important to long-term economic growth. in the modern economy, human and physical capital are generally less important in productivity than natural resources. in the 19th century, countries with the highest per capita gdp were nearly always abundant in minerals and productive farming land.

Answers: 1

Business, 22.06.2019 21:40

Western electric has 32,000 shares of common stock outstanding at a price per share of $79 and a rate of return of 13.00 percent. the firm has 7,300 shares of 7.80 percent preferred stock outstanding at a price of $95.00 per share. the preferred stock has a par value of $100. the outstanding debt has a total face value of $404,000 and currently sells for 111 percent of face. the yield to maturity on the debt is 8.08 percent. what is the firm's weighted average cost of capital if the tax rate is 39 percent?

Answers: 2

You know the right answer?

Analyze the Production Possibilities Curve below. Explain opportunity costs and scarcity and how it...

Questions

Mathematics, 17.01.2022 14:00

Geography, 17.01.2022 14:00

Mathematics, 17.01.2022 14:00

History, 17.01.2022 14:00

Mathematics, 17.01.2022 14:00

Business, 17.01.2022 14:00

Computers and Technology, 17.01.2022 14:00

English, 17.01.2022 14:00

English, 17.01.2022 14:00

Computers and Technology, 17.01.2022 14:00