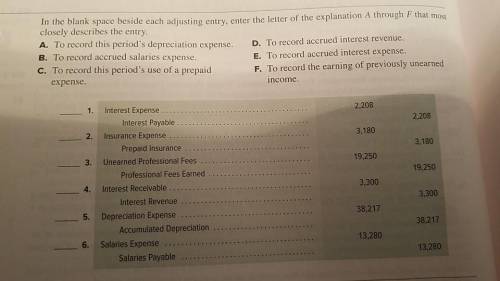

In the blank space beside each adjusting entry, enter the letter of the explanation A through Fthat most closely describes the entry

A To record this period's depreciation expense.

B. To record accrued salaries expense.

C. To record this period's use of a prepaid expense

D. To record accrued interest revenue

E. To record accrued interest expense.

F. To record the earning of previously unearned income.

Interest Expense 2,208

Interest Payable 2,208

Insurance Expense 3,180

Prepaid Insurance 3.180

Unearned Professional Fees19,250

Professional Fees Earned 19,250

Interest Receivable 3,300

Interest Revenue 3,300

Answers: 3

Another question on Business

Business, 22.06.2019 03:40

Your parents have accumulated a $170,000 nest egg. they have been planning to use this money to pay college costs to be incurred by you and your sister, courtney. however, courtney has decided to forgo college and start a nail salon. your parents are giving courtney $20,000 to her get started, and they have decided to take year-end vacations costing $8,000 per year for the next four years. use 8 percent as the appropriate interest rate throughout this problem. use appendix a and appendix d for an approximate answer, but calculate your final answer using the formula and financial calculator methods. a. how much money will your parents have at the end of four years to you with graduate school, which you will start then?

Answers: 1

Business, 22.06.2019 19:30

Dollar shave club is an ecommerce start-up that delivers razors to its subscribers by mail. by doing this, dollar shave club is using a(n) to disrupt an existing market.a. innovation ecosystem b. architectural innovation c. business model innovation d. incremental innovation

Answers: 2

Business, 22.06.2019 22:00

On january 8, the end of the first weekly pay period of the year, regis company's payroll register showed that its employees earned $22,760 of office salaries and $70,840 of sales salaries. withholdings from the employees' salaries include fica social security taxes at the rate of 6.20%, fica medicare taxes at the rate of 1.45%, $13,260 of federal income taxes, $1,450 of medical insurance deductions, and $860 of union dues. no employee earned more than $7,000 in this first pay period. required: 1.1 calculate below the amounts for each of these four taxes of regis company. regis’s merit rating reduces its state unemployment tax rate to 3% of the first $7,000 paid to each employee. the federal unemployment tax rate is 0.60

Answers: 3

You know the right answer?

In the blank space beside each adjusting entry, enter the letter of the explanation A through Fthat...

Questions

History, 29.03.2020 22:13

Computers and Technology, 29.03.2020 22:14

Mathematics, 29.03.2020 22:14

Mathematics, 29.03.2020 22:14

Social Studies, 29.03.2020 22:14

Mathematics, 29.03.2020 22:14

Biology, 29.03.2020 22:14

Mathematics, 29.03.2020 22:14

Mathematics, 29.03.2020 22:15

Mathematics, 29.03.2020 22:15