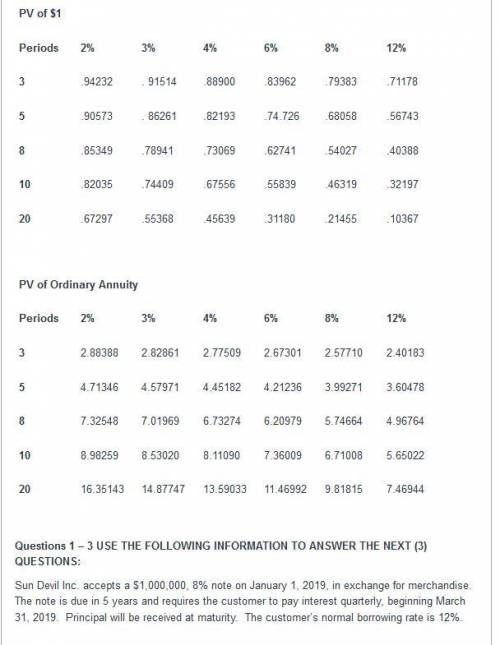

Long-Term Notes Receivable and TVM. Use the following present value tables to help answer the following questions. *Do not round any answer until your final answer. Round your final answer to the nearest whole dollar. When entering your final answer, do not use commas or $ sign. (Sorry...Blackboard is very sensitive and will mark your answer incorrect due to rounding and punctuation.)

PV of $1

Periods 4% 6% 8% 9%

3 .89 .84 .79 .77

5 .82 .74 .68 .65

9 .70 .59 .50 .46

10 .68 .56 .46 .42

Present Value of an Ordinary Annuity

Period 4% 6% 8% 9%

3 2.77 2.67 2.57 2.53

5 4.45 4.21 3.99 3.89

9 7.43 6.80 6.25 5.99

10 8.11 7.36 6.71 6.41

USE THE FOLLOWING INFORMATION TO ANSWER THE NEXT (3) QUESTIONS:Sun Devil Inc. accepts a $1,000,000, 8% note on January 1, 2019, in exchange for merchandise. The note is due in 5 years and requires the customer to pay interest quarterly, beginning March 31, 2019. Principal will be received at maturity. The customer’s normal borrowing rate is 12%. Determine the amount of Sales Revenue Sun Devil can recognize on Jan 1, 2019: $Using the information in #1 above, determine the carrying value of the Note Receivable at December 31, 2021: $Using the information in #1 above, determine the Total Interest Revenue Sun Devil will earn over the entire 5-year lending agreement:$

Answers: 3

Another question on Business

Business, 21.06.2019 19:20

Astock with a beta of 0.6 has an expected rate of return of 13%. if the market return this year turns out to be 10 percentage points below expectations, what is your best guess as to the rate of return on the stock? (do not round intermediate calculations. enter your answer as a percent rounded to 1 decimal place.)

Answers: 2

Business, 22.06.2019 00:30

How did lani lazzari show her investors she was a good investment? (site 1)

Answers: 3

Business, 22.06.2019 23:10

Powell company began the 2018 accounting period with $40,000 cash, $86,000 inventory, $60,000 common stock, and $66,000 retained earnings. during 2018, powell experienced the following events: sold merchandise costing $58,000 for $99,500 on account to prentise furniture store. delivered the goods to prentise under terms fob destination. freight costs were $900 cash. received returned goods from prentise. the goods cost powell $4,000 and were sold to prentise for $5,900. granted prentise a $3,000 allowance for damaged goods that prentise agreed to keep. collected partial payment of $81,000 cash from accounts receivable. required record the events in a statements model shown below. prepare an income statement, a balance sheet, and a statement of cash flows. why would prentise agree to keep the damaged goods?

Answers: 2

Business, 23.06.2019 10:00

When the amount paid for land is $36,000 and the amount paid for expenses is $10,000, the balance in total assets after transaction (b) is

Answers: 1

You know the right answer?

Long-Term Notes Receivable and TVM. Use the following present value tables to help answer the follo...

Questions

Mathematics, 18.10.2021 01:00

Computers and Technology, 18.10.2021 01:00

Mathematics, 18.10.2021 01:00

English, 18.10.2021 01:00

Mathematics, 18.10.2021 01:00

Mathematics, 18.10.2021 01:00

Mathematics, 18.10.2021 01:00

Mathematics, 18.10.2021 01:00

Mathematics, 18.10.2021 01:00

Mathematics, 18.10.2021 01:00

English, 18.10.2021 01:00

French, 18.10.2021 01:00

Biology, 18.10.2021 01:00

Social Studies, 18.10.2021 01:00

Mathematics, 18.10.2021 01:00

Mathematics, 18.10.2021 01:00