Business, 18.06.2020 21:57 mmsomefood85

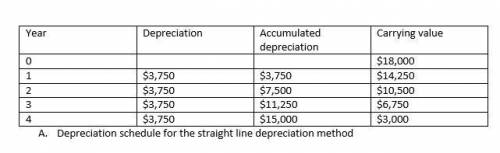

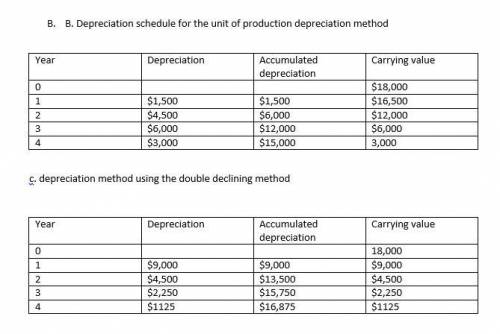

Crispy Fried Chicken bought equipment on January 2, 2016, for $ 18 comma 000. The equipment was expected to remain in service for four years and to perform 3 comma 000 fry jobs. At the end of the equipment's useful life, Crispy estimates that its residual value will be $ 3 comma 000. The equipment performed 300 jobs the first year, 900 the second year, 1 comma 200 the third year, and 600 the fourth year. Requirements 1. Prepare a schedule of depreciation expense, accumulated depreciation, and book value per year for the equipment under the three depreciation methods. Show your computations. Note: Three depreciation schedules must be prepared. 2. Which method tracks the wear and tear on the equipment most closely?

Answers: 2

Another question on Business

Business, 22.06.2019 10:00

Your father offers you a choice of $120,000 in 11 years or $48,500 today. use appendix b as an approximate answer, but calculate your final answer using the formula and financial calculator methods. a-1. if money is discounted at 11 percent, what is the present value of the $120,000?

Answers: 3

Business, 22.06.2019 10:30

What type of budget is stated? a budget is a type of financial report that scrutinizes the inflow and outflow of money in a given financial year.

Answers: 1

Business, 22.06.2019 12:10

Compute the cost of not taking the following cash discounts. (use a 360-day year. do not round intermediate calculations. input your final answers as a percent rounded to 2 decimal places.)

Answers: 1

You know the right answer?

Crispy Fried Chicken bought equipment on January 2, 2016, for $ 18 comma 000. The equipment was expe...

Questions

French, 21.05.2020 23:07

Mathematics, 21.05.2020 23:07

Medicine, 21.05.2020 23:07

Arts, 21.05.2020 23:07

Mathematics, 21.05.2020 23:07

English, 21.05.2020 23:07

Mathematics, 21.05.2020 23:07

Mathematics, 21.05.2020 23:07

History, 21.05.2020 23:07

Mathematics, 21.05.2020 23:07