Business, 19.06.2020 02:57 shakira11harvey6

Ignacio, Inc., had after-tax operating income last year of $1,197,000. Three sources of financing were used by the company: $2 million of mortgage bonds paying 4 percent interest, $4 million of unsecured bonds paying 6 percent interest, and $9 million in common stock, which was considered to be relatively risky (with a risk premium of 8 percent). The rate on long-term treasuries is 3 percent. Ignacio, Inc., pays a marginal tax rate of 30 percent.

Required:

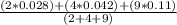

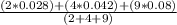

1. Calculate the after-tax cost of each method of financing. Enter your answers as decimal values rounded to three places. For example, 4.36% would be entered as ".044".

Mortgage bonds

Unsecured bonds

Common stock

2. Calculate the weighted average cost of capital for Ignacio, Inc. Round intermediate calculations to four decimal places. Round your final answer to four decimal places before converting to a percentage. For example, .06349 would be rounded to .0635 and entered as "6.35" percent.

%

Calculate the total dollar amount of capital employed for Ignacio, Inc.

$

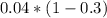

3. Calculate economic value added (EVA) for Ignacio, Inc., for last year. If the EVA is negative, enter your answer as a negative amount.

$

Is the company creating or destroying wealth?

Destroying

4. What if Ignacio, Inc., had common stock which was less risky than other stocks and commanded a risk premium of 5 percent? How would that affect the weighted average cost of capital?

Lower

What is the new EVA? In your calculations, round weighted average percentage cost of capital to four decimal places. If the EVA is negative, enter your answer as a negative amount.

$

Answers: 3

Another question on Business

Business, 21.06.2019 18:50

Which of the following is not a potential problem with beta and its estimation? sometimes, during a period when the company is undergoing a change such as toward more leverage or riskier assets, the calculated beta will be drastically different than the "true" or "expected future" beta. the beta of "the market," can change over time, sometimes drastically.

Answers: 3

Business, 22.06.2019 11:40

You are a manager at asda. you have been given the demand data for the past 10 weeks for swim rings for children. you decide to run multiple types of forecasting methods on the data to see which gives you the best forecast. if you were to use exponential smoothing with alpha =.8, what would be your forecast for week 22? (the forecast for week 21 was 1277.) week demand 12 1317 13 1307 14 1261 15 1258 16 1267 17 1256 18 1268 19 1277 20 1277 21 1297

Answers: 3

Business, 22.06.2019 16:30

Suppose that electricity producers create a negative externality equal to $5 per unit. further suppose that the government imposes a $5 per-unit tax on the producers. what is the relationship between the after-tax equilibrium quantity and the socially optimal quantity of electricity to be produced?

Answers: 2

Business, 22.06.2019 20:00

Because this market is a monopolistically competitive market, you can tell that it is in long-run equilibrium by the fact thatmr=mc at the optimal quantity for each firm. furthermore, a monopolistically competitive firm's average total cost in long-run equilibrium isless than the minimum average total cost. true or false: this indicates that there is a markup on marginal cost in the market for engines. true false monopolistic competition may also be socially inefficient because there are too many or too few firms in the market. the presence of the externality implies that there is too little entry of new firms in the market.

Answers: 3

You know the right answer?

Ignacio, Inc., had after-tax operating income last year of $1,197,000. Three sources of financing we...

Questions

Spanish, 22.09.2019 07:50

Mathematics, 22.09.2019 07:50

Mathematics, 22.09.2019 07:50

Computers and Technology, 22.09.2019 07:50

Mathematics, 22.09.2019 07:50

History, 22.09.2019 07:50

History, 22.09.2019 07:50

Arts, 22.09.2019 07:50

Chemistry, 22.09.2019 07:50

Mathematics, 22.09.2019 07:50

Social Studies, 22.09.2019 07:50

=

=

=

=