Business, 19.06.2020 03:57 bethania26

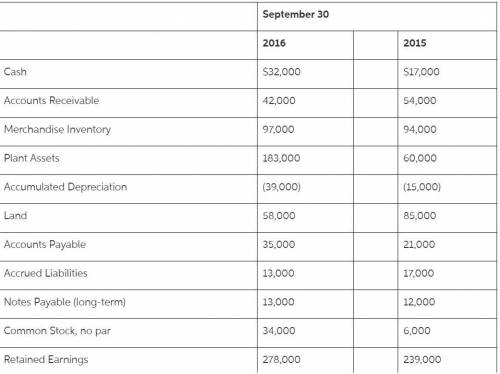

Complete the statement one section at a time, beginning with the cash flows from operating activities. (Use parentheses or a minus sign for numbers to be subtracted. If a box is not used in the statement, leave the box empty; do not select a label or enter a zero.) LOOK BELOW FOR INCOME STAT AND ADDITIONAL INFO

Energy Plus, Inc.

Income Statement

Year Ended September 30, 2016

Sales Revenue

$235,000

Cost of Goods Sold

99,000

Gross Profit

136,000

Operating Expenses:

Salaries Expense

$58,000

Depreciation Expense—Plant Assets

24,000

Total Operating Expenses

82,000

Net Income Before Income Taxes

54,000

Income Tax Expense

7,000

Net Income

$47,000

a. Acquisition of plant assets is

$123,000.

Of this amount,

$110,000

is paid in cash and

$13,000

by signing a note payable.

b. Cash receipt from sale of land totals

$27,000.

There was no gain or loss.

c. Cash receipts from issuance of common stock total

$28,000.

d. Payment of note payable is

$12,000.

e. Payment of dividends is

$8,000.

f. From the balance sheet:

Answers: 1

Another question on Business

Business, 22.06.2019 21:00

Sue peters is the controller at vroom, a car dealership. dale miller recently has been hired as the bookkeeper. dale wanted to attend a class in excel spreadsheets, so sue temporarily took over dale's duties, including overseeing a fund used for gas purchases before test drives. sue found a shortage in the fund and confronted dale when he returned to work. dale admitted that he occasionally uses the fund to pay for his own gas. sue estimated the shortage at $450. what should sue do?

Answers: 3

Business, 22.06.2019 21:30

Consider the following three bond quotes; a treasury note quoted at 87.25, and a corporate bond quoted at 102.42, and a municipal bond quoted at 101.45. if the treasury and corporate bonds have a par value of $1,000 and the municipal bond has a par value of $5,000, what is the price of these three bonds in dollars? multiple choice $872.50, $1,000, $1,000, respectively $1,000, $1,024.20, $1,001.45, respectively $872.50, $1,024.20, $5,072.50, respectively $1,000, $1,000, $1,000, respectively

Answers: 3

Business, 22.06.2019 22:00

In 2018, laureen is currently single. she paid $2,800 of qualified tuition and related expenses for each of her twin daughters sheri and meri to attend state university as freshmen ($2,800 each for a total of $5,600). sheri and meri qualify as laureen’s dependents. laureen also paid $1,900 for her son ryan’s (also laureen’s dependent) tuition and related expenses to attend his junior year at state university. finally, laureen paid $1,200 for herself to attend seminars at a community college to her improve her job skills.what is the maximum amount of education credits laureen can claim for these expenditures in each of the following alternative scenarios? a. laureen's agi is $45,000.b. laureen’s agi is $95,000.c. laureen’s agi is $45,000 and laureen paid $12,000 (not $1,900) for ryan to attend graduate school (i.e, his fifth year, not his junior year).

Answers: 2

Business, 22.06.2019 23:00

Investors who put their own money into a startup are known as a. mannequins b. obligators c. angels d. borrowers

Answers: 1

You know the right answer?

Complete the statement one section at a time, beginning with the cash flows from operating activitie...

Questions

English, 08.04.2021 06:30

Mathematics, 08.04.2021 06:30

Biology, 08.04.2021 06:30

Mathematics, 08.04.2021 06:30

Mathematics, 08.04.2021 06:30

Chemistry, 08.04.2021 06:30

Chemistry, 08.04.2021 06:30

Health, 08.04.2021 06:30

Mathematics, 08.04.2021 06:30

Biology, 08.04.2021 06:30